- Summary:

- The EasyJet share price is facing increasing bearish pressure as the Omicron-induced travel bans threatens travel to EU holiday spots.

The EasyJet share price has pared some of its intraday losses and is pushing higher this Wednesday. However, it remains under some pressure even as governments worldwide tighten restrictions on inbound travel from certain countries suspected of being the origins of the Omicron coronavirus variant.

On Wednesday, the Foreign Office issued new travel advisories to holiday hotspots around Europe, with revised travel advisories for Spain, Germany, Portugal, Italy and Greece. The new rules indicate that compulsory vaccination is now required at some European borders, along with negative PCR tests in some locations. These are all expected to impact holiday season travel, posing headwinds to airline stocks.

The EasyJet share price is trading slightly lower by 1.23%, even as analysts at Berenberg lowered their price forecast for the stock last week from 800p to 750p, citing concerns about the emergence of the Omicron variant.

EasyJet Share Price Outlook

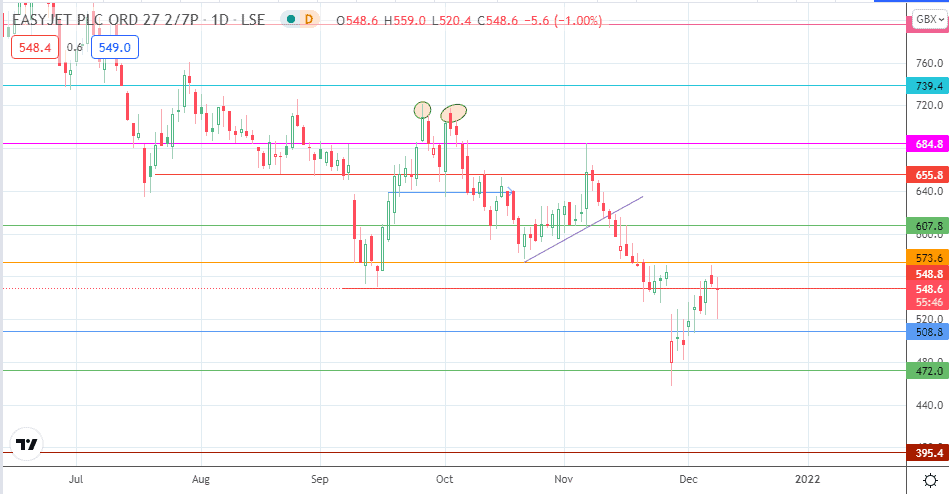

The active daily candle has met resistance at the 548.8 resistance mark. A break of this level targets 573.6, with bulls needing to take out this new resistance to target 607.8 and possibly 640.0 (19 October and 10 November highs).

On the other hand, rejection at 548.8 opens the door for a pullback towards 508.80. If the bulls fail to defend this support, 472.00 enters the picture. If this pivot breaks down, this will signal a resumption of the bearish trend.

EasyJet: Daily Chart

Follow Eno on Twitter.