- The recent drop in the easyJet share price could present dip-buying opportunities for discerning investors.

This Tuesday, the easyJet share price is trading higher by 0.18% after the bulls reversed the stock’s earlier session losses. The stock has been under pressure in the last week as staff shortages continue to pile pressure on the airline’s operations. As a result, the stock appeared headed to mark a sixth losing session before the bulls seized control of the day’s proceedings.

The recent declines were triggered after the company cancelled leases on Airbus jets owned by Russian state-owned leasing group GTLK due to the UK’s sanctions on Russian entities. This was followed by a report from the Financial Times of London in which the pilots’ union Balpa had accused the company of corporate bullying in handling COVID-related staff absences. The absences had led to the cancellation of hundreds of flights recently.

The latest 12-month price target for easyJet is 696.27p, which gives the stock a potential upside of 41.67%. Providing some impetus to this easyJet share price target on the fundamental side of things is the positive outlook provided by CEO Johan Lundgren on the potential for attaining pre-pandemic passenger volumes in the summer season.

EasyJet Share Price Forecast

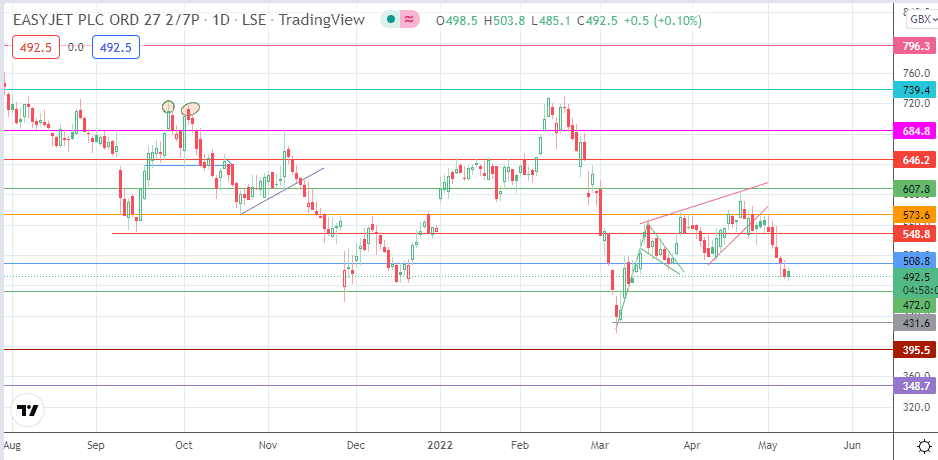

The decline from the breakdown of the falling wedge pattern has extended below the completion point of the measured move at 508.8 (21 December 2021 and 25 March 2022 lows). The breakdown of this support has opened the door for a move south, targeting the underlying support at 472.0 (4 March low). Additional targets to the south that could serve as potential harvest points for those selling the wedge breakdown are 431.6 (8 March low) and 395.5 (22 September 2020/28 October 2020 lows).

On the flip side, the bulls would be seeking a bounce at a pivot (potentially at 472.0) to reverse the trend, targeting 508.8 initially before 548.8 comes into the picture as an additional northbound target. If the bulls uncap this barrier, 573.6 (29 March and 3 May highs) becomes the next target to the north, before 607.8 becomes another price barrier if the advance continues beyond 573.6.

EasyJet: Daily Chart

Follow Eno on Twitter.