- Summary:

- The EasyJet share price is moving sideways as investors reflect on the ongoing flight cancellations in the UK.

The EasyJet share price is moving sideways as investors reflect on the ongoing flight cancellations in the UK. The stock has moved to 535p, which is about 13.8% above the lowest level this month. The firm has a market cap of over 4 billion pounds, which is lower than what Wizz Air offered for it in 2021. The stock is about 42% below its highest point in April 2021.

Half-term cancellations

Like other regional airlines, EasyJet is expected to do well during the Summer period as people travel freely. Besides, most people could not travel during the Covid-19 pandemic. Now, the company has another challenge of flight cancellations as the number of booking surge. Easyet cancelled about 200 flights as it blamed a computer glitch for the error.

Still, the company is expected to continue doing well. In the results published last week, the company said its loss narrowed to 545 million pounds as it allocated more than 1.5 million seats to the most profitable markets. The company also expects to operate 90% of its FY19 capacity in the third quarter of this year. Also, the company’s leisure and domestic routes have recovered by about 113%.

The company is still struggling with the rising jet fuel prices. Still, these prices will likely be positive for the firm when they start reducing. However, at that time, it will likely leave ticket prices at a higher level than where they were before the pandemic.

EasyJet share price forecast

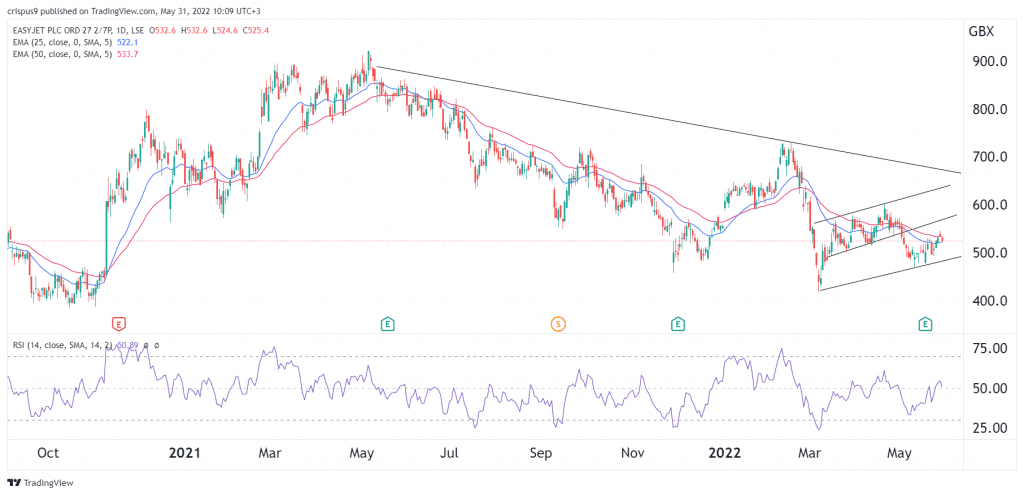

The four-hour chart shows that the EZJ share price has been in a slow upward trend in the past few weeks. The stock remains between the lower and middle line of the ascending channels. At the same time, it is consolidating at the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved to the neutral point at 50.

Therefore, the EasyJet share price will likely continue crawling back as investors target the middle trendline at around 560p. On the flip side, a drop below the support at 500p will invalidate the bullish view.