- Summary:

- EasyJet share price has been in a strong bullish trend in the past few weeks as investors bet that the regional sector will rebound this year

The EasyJet share price has been in a strong bullish trend in the past few weeks as investors bet that the regional sector will rebound this year. The EZJ stock is trading at 629p, which is about 37.70% above the lowest level in December.

EasyJet is a leading regional company that is valued at more than 4.77 billion pounds. The company had a mixed 2021 as the industry recovered at a slower pace than expected. After soaring to a high of 921p in May, the stock crashed by 50% and reached a low of 470p in November.

The sell-off was mostly because of the rising number of Covid-19 cases in Europe and the fact that the company rejected an acquisition bid by Wizz Air, a leading budget carrier in the region.

Still, while EasyJet is facing challenges this year, there is a likelihood that the stock will do better this year. For one, the feared Omicron variant has emerged to be less severe than the other variants. Indeed, while the number of infections has risen, the number of deaths and hospitalizations has been low.

EasyJet share price forecast

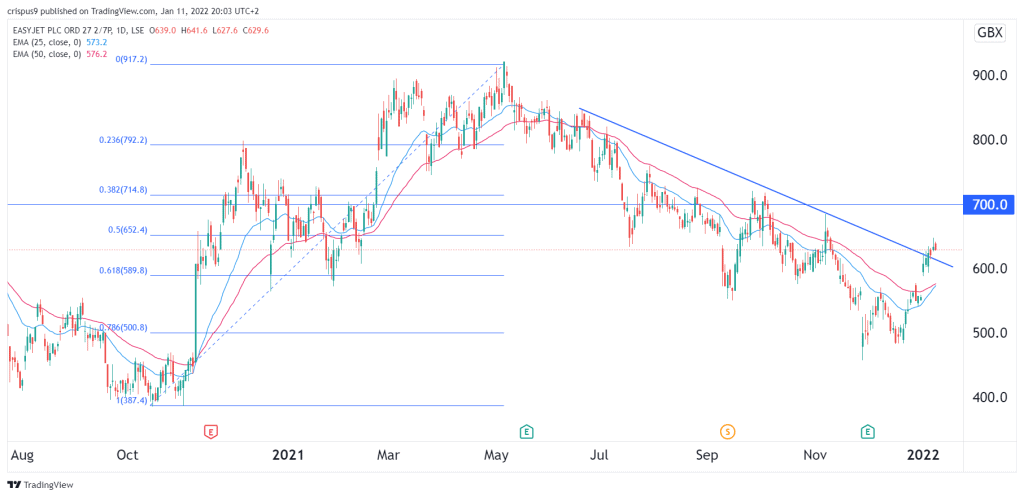

The daily chart shows that the EasyJet share price has been in a strong bullish trend in the past few months. The stock managed to move above the descending trendline shown in blue. It also moved close to the 50% Fibonacci retracement level. The 25-day and 50-day moving averages are attempting to form a mini golden cross pattern.

Therefore, there is a likelihood that the stock will keep rising as bulls target the key resistance at 700p, which is about 12% above the current level. This view will be invalidated if the price falls below 590p.