- Summary:

- The long road to recovery for the easyJet share price could begin this month as the stock posts two days of good gains.

The easyJet share price (LON: EZJ) is sharply higher for the second day in a row, as the stock makes a blistering start to the new week. This new demand comes as investors try to profit from bargain prices as the company adds a new route for European users.

Shares in the budget airline rose 7.85% on Wednesday in early trading in London, as investors applauded the launch of new flights from Lille to Palma de Mallorca. This seasonal connection will kick off on 1 May, adding another route to its Lille departure point to further augment destinations like Toulouse, Nantes, Nice, and Geneva.

Ahead of the holiday travel season which starts in three months, this route gives travelers from Belgium greater accessibility to southern destinations. The easyJet share price had endured more than its fair share of a selloff, after stocks listed in the London Stock Exchange took a hammering following Russia’s invasion of Ukraine. It now starts a long road to recovery, having fallen from 631p on 24 February (invasion day) to a low of 417.4p on Friday 4 March.

easyJet Share Price Outlook

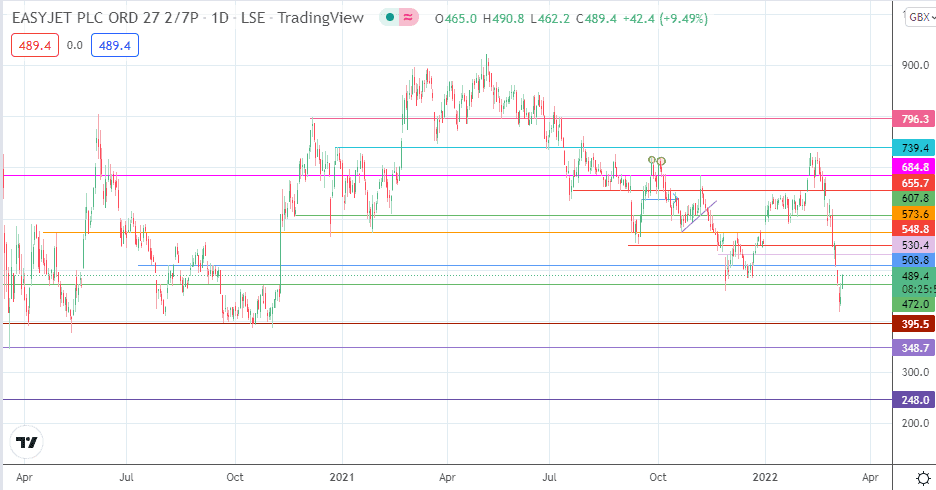

Wednesday’s uptick has violated the 472.0 resistance level and appears to be on course to touch off the next upside target at 508.8. If the bulls uncap this resistance barrier, 530.4 and 548.8 will enter the mix as the new targets to the north.

On the flip side, the bears would need the price to take out the 4 March low at 417.4 for the 395.5 support level (21 September to 3 November lows) to become a viable downside target. Below this mark, the 16 March 2020 low at 348.7 becomes the new downside target.

easyJet: Daily Chart

Follow Eno on Twitter.