- Summary:

- This is the EasyJet share price forecast after the stock looks set to end another month in negative territory.

If you are wondering why the EasyJet share price is unmoved this Monday, it is because the UK stock markets are closed due to the Summer Bank Holiday. The stock has endured a relentless selloff, which has seen it shed nearly 14% off its value in the last two weeks.

The series of cancellations of Easyjet flights amid a strike from its Spanish hub pilots triggered this latest round of selling. 19 August saw the cancellation of fourteen flights after the commencement of a three-day strike by the SEPLA pilots union in Spain. The pilots are asking that pre-COVID working conditions and pay be reinstated. The EasyJet share price fell 6.29% that day, and the selloff has continued.

Further flight cancellations from Gatwick Airport (26 in total on 23 August) and not even a declaration of normalization of its business conditions at its half-year earnings call could stop the slide. The exit of three board members has compounded the situation.

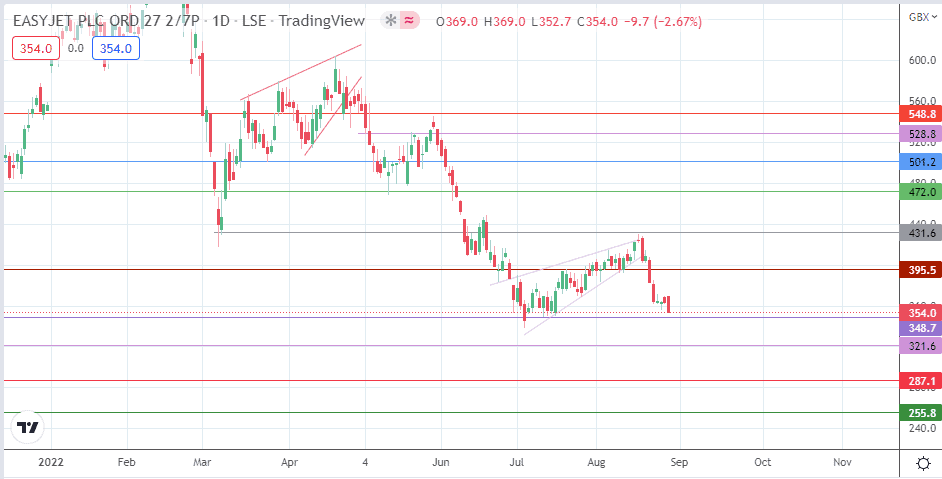

Tuesday’s market session will be a test of the resolve of the bulls to protect the current support in an attempt to stop the slide toward 12-year lows. The EasyJet share price closed 2.67% lower on Friday, even as the charts show a bearish flag currently in evolution.

EasyJet Share Price Forecast

The 348.7 support level (20 March 2020 and 12 July 2022 lows) remains vulnerable to the prevailing fundamentals. A breakdown of this level targets the 321.6 support, formed by prior lows of 5 January 2012. A further decline completes the bearish flag pattern at the 287.1 pivot formed by the previous low of 31 August 2010 and 23 May 2011. 255.8 rounds off potential downside targets, as it houses the previous lows of 19 July 2011 and 12 September 2011.

Successful protection of the 348.7 pivot by the bulls invalidates the previous outlook. A bounce from this area targets the 395.5 resistance. If the bulls clear this barrier, they will have clear skies to aim for the 431.6 resistance barrier (16 August 2022 high). Above this level, additional targets available on a price advance are 472.0 (12 May 2022 low) and 501.2, where the 24 March and 18 May 2022 lows are found.

EasyJet: Daily Chart