- The US dollar index (DXY) declined sharply on Friday after the relatively mixed US jobs numbers. What next?

The US dollar index (DXY) declined sharply on Friday after the relatively mixed US jobs numbers. The DXY, which tracks the greenback against a basket of currencies, declined to $95.7, which was lower than last year’s high of $96.90.

US inflation data ahead

The Bureau of Labor Statistics (BLS) published mixed jobs numbers last Friday. The data revealed that the American economy added just 199k jobs in December. That was a surprise considering that analysts were expecting that the economy will add over 422k jobs.

On the positive side, the data showed that the country’s unemployment rate declined to 3.9% in December, the lowest level since the pandemic started. Also, data revealed that the country’s wages rose by 0.6% in December, leading to an annual increase of 4.7%. Therefore, there is a likelihood that the Federal Reserve will remain being hawkish.

The next key data to move the dollar index will be inflation, which will come out on Tuesday. Economists expect that the headline consumer inflation rose from 6.8% in November to 7.0% in December. Core inflation, which excludes the volatile food and energy prices, is expected to have increased from 4.9% to 5.4%.

US dollar index forecast

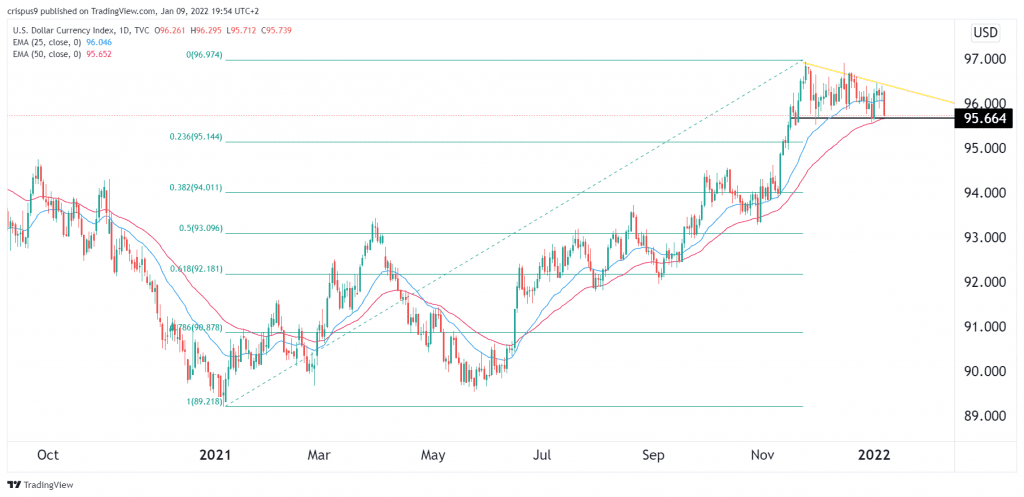

The daily chart shows that the DXY index has been in a tight range in the past few weeks. It is trading at a key support level, where it has struggled to move below several times. Also, the index is oscillating between the 25-day and 50-day moving averages while the Stochastic Oscillator has tilted lower.

It is also approaching the 23.6% Fibonacci retracement level. Therefore, the index will likely have a bearish breakout as bears target the key 23.6% retracement level at $95.15. On the flip side, a move above $96.50 will invalidate the bearish view.