- Summary:

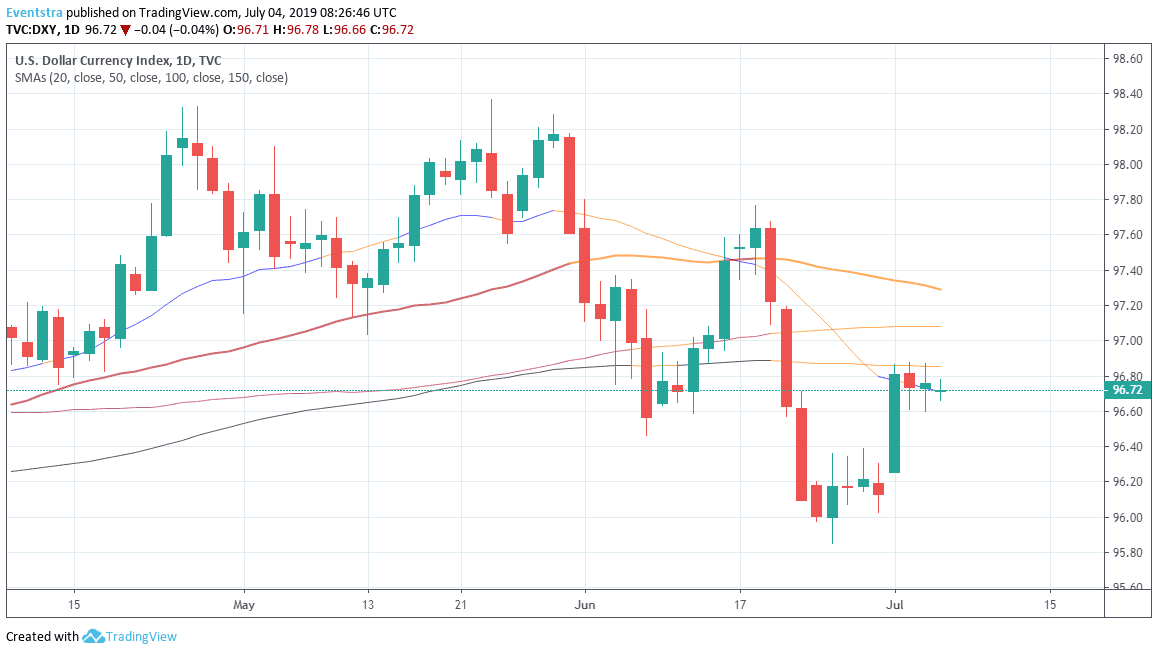

- Dollar index trading slightly lower at 96.72 in thin trading and narrow trading range as the US markets are closed today for the 4th July celebrations

Dollar index trading slightly lower at 96.72 in thin trading and narrow trading range (10 pips) as the US markets are closed today for the 4th July celebrations. Yesterday US data failed to impress investors as the US initial jobless claims for the week of June 29th came in at 221,000 versus forecasts of 223,000 the prior week revised higher to 229,000 versus 227,000. The 4 week average came at 222.25K versus 221.75K. The Continuing Jobless Claims came in at 1.686M, beating analysts’ forecasts of 1.675M for June 21. The U.S. Trade Balance recorded at $-55.5B worst than analysts’ expectations from $-54B in May. The US exports increased by 2.0% while the Imports increased by 3.3%. The US China May deficit was at $30.2B vs $26.9B before.

DXY managed to rebound from the previous week low at 95.85 and currently consolidates above mid 96 after piercing the 50 and 100 hourly moving averages getting a boost from better macro figures. The positive momentum holds well but I am looking for a sustained move above 96.77 the 20 day moving average to enter long positions and signal the return of buyers in the index. On the downside immediate support stands at 96 psychological mark while more bids will emerge at 95.85 previous week low. First resistance stands at 97.08 the 100 day moving average while more will probably emerge at 97.74 the high from June 18th.Don’t miss a beat! Follow us on Twitter.