- Summary:

- Indices in Wall Street started higher on Monday with the Dow Jones adding 66 points to 26,132 as traders await the key Federal Reserve meeting on Wednesday

Indices in Wall Street started higher on Monday with the Dow Jones adding 66 points to 26,132 as traders await the key Federal Reserve meeting on Wednesday for clues on the Central Banks next move. This will be one of the most important meetings, where apart from the rate decision, the statement and press conference, we also get updated economic projections, and a new “dot plot”. The July futures suggest a 66.6% chance of a cut as inflation slows and the global economy weakens. Another decrease is more-than-factored in for November. Earlier today the United States NAHB Housing Market Index registered at 64, below expectations (67) in June. Meanwhile European equities are trading slightly higher on the back of hopes for further economic stimulus in China.

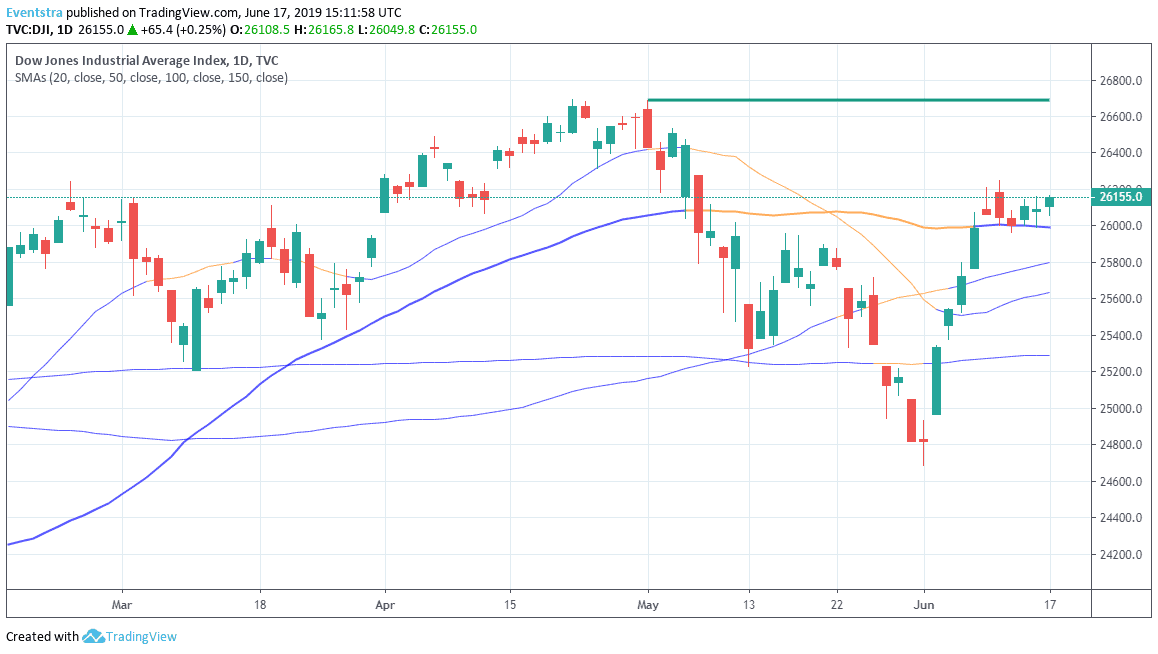

The technical picture remains positive for the DJIA as it holds above the 50 day moving average and also stays above the key 61.8% Fibo retracement level of April to June swing highs and lows. Major support for the index stands at the 100 day moving average at 25,797 and a break below can lead the prices down to 25,000 zone. On the upside major resistance is located at 26,700 the high from May 1st.