- Summary:

- The Dow Jones index soared to the highest level since 9th June of this year as investors reacted to the latest earnings and FOMC decision

The Dow Jones index soared to the highest level since 9th June of this year as investors reacted to the latest earnings and FOMC decision. It rose to $32,326, which is about 8.3% above the lowest level this month. At the same time, the closely watched fear and greed index remains stuck at the fear zone of 38. Other American indices like the S&P 500 and Nasdaq 100 also tilted higher.

Fed, earnings, and US GDP

The Dow Jones jumped sharply after the Federal Reserve delivered its interest rate decision. The bank decided to hike rates by 0.75% and hinted that it will continue tightening in a bid to fight the soaring inflation. In his press conference, Jerome Powell said that the bank was attempting to find the right balance for a soft landing. The US will publish the latest GDP numbers on Thursday.

Dow Jones also rose after the current slew of corporate earnings from the United States. Constituent companies like Microsoft, Visa, and Boeing published weak results as the cost of doing business rose. Other companies that published weak results were Meta Platforms, Shopify, Bunge, and Garmin among others.

The earnings season will continue on Thursday as companies like T.Rowe Price, Willis Towers Watson, Northrop Grumman, Comcast, and Southern Companies are expected to publish their results. Analysts expect that these firms will warn about the soaring cost of doing business.

The Dow Jones index has done well as the fear and greed index has moved from the extreme fear level. The stock price strength sub-index has even moved to the extreme greed level, meaning that the net new 52-week highs has beaten companies hitting their 52-week lows. The junk bond demand, stock price breadth, and market momentum are still in the fear level.

Dow Jones forecast

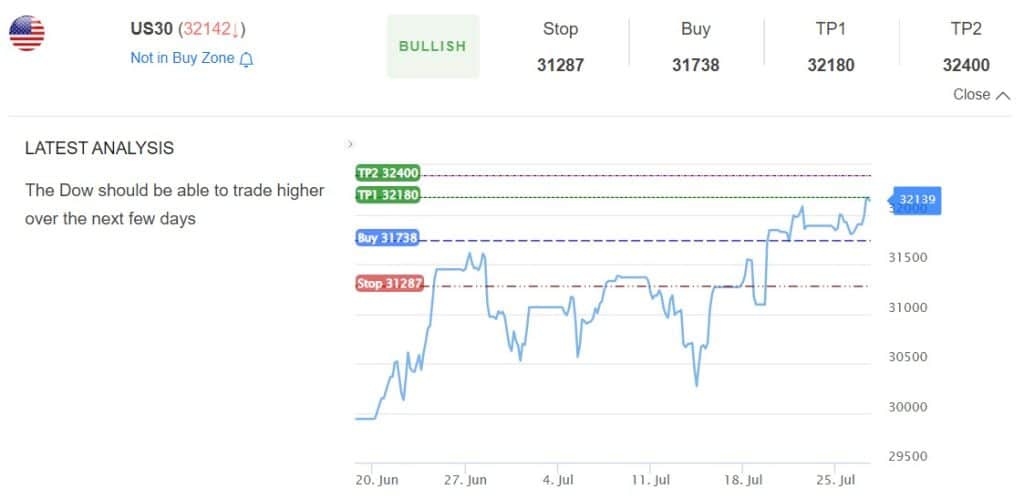

The four-hour chart shows that the Dow Jones index rose above the important resistance level at $31,717 after the latest Fed decision. This was an important level since it was along the 50-day exponential moving averages. The Relative Strength Index (RSI) has moved above the neutral point at 50. Also, it has formed a small head and shoulders pattern.

Therefore, the Dow Jones index will likely keep rising. The closely-followed and highly accurate InvestingCube S&R indicator implies that the index will rise to $3,400 as shown below. The stop loss for this view is at $31,287.