- Summary:

- The Dow has opened the day sharply lower after the Chinese government allowed the Yuan to drop sharply, escalating the US-China trade war.

The Dow Jones Industrial Average futures plunged more than 350 points prior to Monday’s market open, as the People’s Bank of China allowed the exchange rate of the Chinese Yuan to fall to the lowest level in a decade against the US Dollar.

This action was an apparent response to Thursday’s 10% tariff slammed on more than $300billion worth of Chinese goods, signaling an escalation of the US-China trade war. US president Donald Trump has responded in a tweet Monday afternoon, labeling the Chinese action as “currency manipulation”. The S&P 500 futures as well as the Nasdaq futures are down 1.5% and 2.1% respectively, following a global market selloff which started in the Asian session.

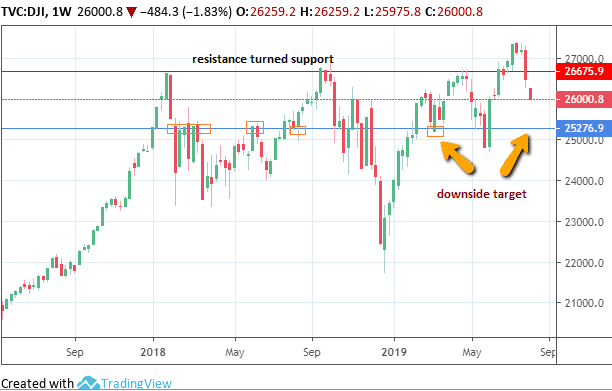

The Dow Jones Industrial Average is now trading below the 26,000 points psychological support level, having opened for the day’s trading with a downside gap. At present levels, the index is now testing the previous resistance-turned-support price levels established by the previous highs of January 2018, September 2018 and April 2019.

If today’s daily candle closes below the present support at 26675, the downside target for the support break would be the March 2019 low at 25276. This price level also corresponds to the 23.6% Fibonacci retracement level in a trace from the swing low of October 2016 to the swing high of July 2019.Don’t miss a beat! Follow us on Twitter.