- Summary:

- Dow Jones breached the 100 day moving average after jumping more than 500 points regaining the short term positive momentum and bulls still controlling

Wall Street indices jumped higher today after a weak start, with the Dow Jones adding 1.85% at 26,384.12. The S&P 500 adds 1.80% at 2,934, while the Nasdaq is 2.19% higher at 8,033 after the Office of the US Trade Representative, announced to delay the additional 10% tariffs on certain Chinese products until December. United States Consumer Price Index (YoY) came in at 1.8%, topping forecasts of 1.7% in July, while the United States Redbook Index (YoY) dipped from previous 5.1% to 4.4% in August 9.

Dow Jones getting a boost from Apple (AAPL) +4.14% at $208.78, Dow Inc. +4.03% and Caterpillar (CAT) +3.08%. On the other hand Coca Cola is 0.32% lower at $53.

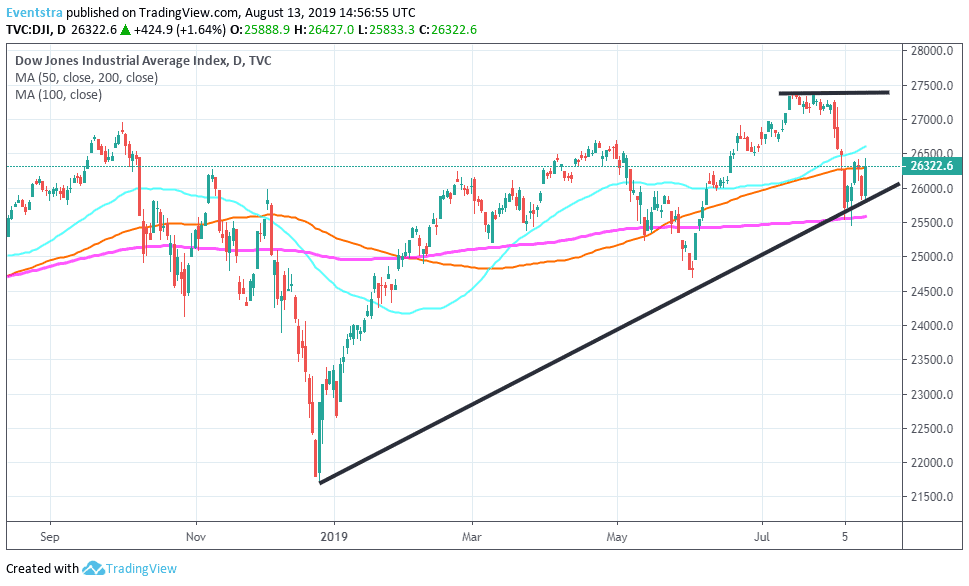

Dow Jones breached the 100 day moving average after jumping more than 500 points regaining the short term positive momentum and bulls still controlling the game for the short term while for the midterm is on a rising trend channel. On the upside immediate resistance is at 26,428 today’s high and then at 26,601 the day moving average. On the downside Dow Jones first support stands at 25,833 today’s low and then at 25,582 the 200 day moving average.

The European Indices turned higher after the positive developments in US – China trade talks, the FTSE 100 is 0.43 percent higher at 7,254 as the pound trades at 1.2070. DAX 30 is adding 0.53 percent at 11,748 while CAC 40 in Paris is 1.12 percent higher at 5,369.