- Summary:

- Rising bond yields are lifting banking stocks on the Dow Jones Industrial Average, allowing it to hit new record highs this Wednesday.

The Dow has hit new all-time highs today after the markets hailed the rise in new orders for US factory goods. Factory goods orders rose 1% in November, which beat expectations (0.7% consensus) in a Bloomberg survey. However, the reading failed to match the previous number, but this did not deter the bulls from sending prices to new record highs.

The Dow was also lifted by rising bank stocks on the back of higher bond yields. The Industrials sector also attracted bids from traders betting on an expanded stimulus that could get easy passage in a Democrat-controlled US government.

The Dow’s surge towards new highs has come due to a 1.6% gain at the time of writing.

Technical Levels to Watch

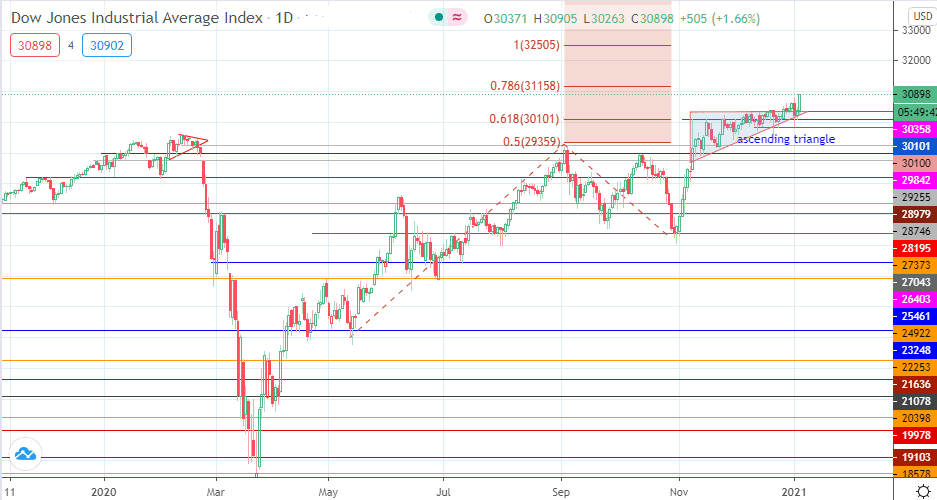

Bulls appear to have set their sights on 31158, which is the 78.6% Fibonacci extension from the 13 May to 2 September 2020 price swing. This move requires a 3% penetration close above the triangle’s upper border to be sustained.

On the flip side, 30358 is the immediate downside target, with 30101 (61.8% Fibonacci extension) and 29842 serving as downside targets in the short term.

Dow Jones Daily Chart