- Summary:

- The Dow Jones Index is set to start Monday higher as equity markets shrug off Friday's highest CPI print in almost 40 years.

The Dow Jones Index is set to start Monday higher as equity markets shrug off Friday’s highest CPI print in almost 40 years.

Major US indices closed higher last week as Friday’s CPI print matched expectations. The US Consumer Price Index (CPI) rose 0.8% last month to 6.8% on an annualized basis, it’s highest YoY reading since 1982. Despite the high print, the US Dollar lost ground, and equities were firmer across the board, and investor confidence remained surprisingly robust.

The Dow finished the week +1,300 points at 35,875, within 1.5% of the all-time-high. Furthermore, futures are up 122 points in Asian trading, suggesting investors are positioning for new highs by the end of the year.

DJIA Price Analysis

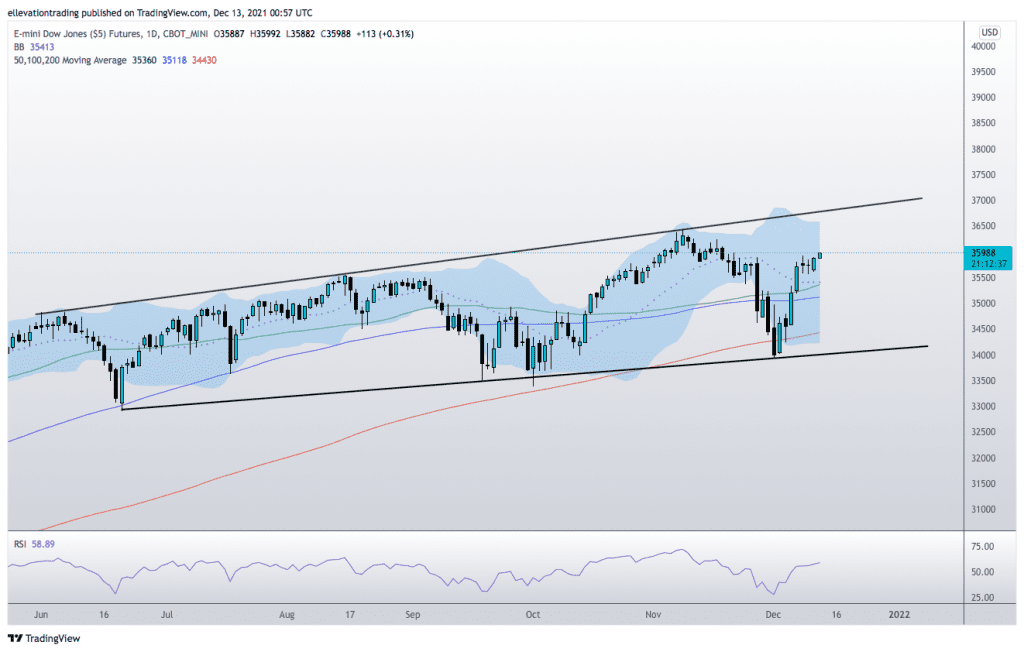

The daily chart shows the Dow Jones Index has fully recovered from the sharp draw-down in November. As a result, the Index is now trading above the 50, 100 and 200-Day Moving Averages.

A continuation of the bullish move is likely to test last month’s all-time at 36,466. However, in that event, a rising trend line at 36,770 should cap the gains initially.

In my opinion, despite last weeks strength, downside risks are exceptionally high. On that basis, I expect to see deleveraging at the higher numbers. Furthermore, if the price reverses below the 100-DMA at 35,119, an extension to the 200-DMA at 34,430 is probable.

Dow Jones Index Futures Chart (Daily)

For more market insights, follow Elliott on Twitter.