- What is the outlook of the Dow Jones index for April 2022? We explain what to expect amid a new normal in the market.

The Dow Jones index staged a strong recovery after crashing to a multi-month low in the first quarter. It is trading at $34,920, about 8.37% above its lowest level in Q1. This price is about 5.44% below its all-time high. Other American indices like the Nasdaq 100, S&P 500, and Russel 2000 had a similar price action in Q1. The same is true with international indexes like the German DAX and French CAC 40.

The Dow Jones recovered in Q1 as investors focused on a number of factors. First, there were concerns about the rising cost of doing business as commodity and labour growth continued. The price of key items like steel, aluminium, oil, and natural gas went parabolic as the crisis in Ukraine escalated. Second, there were issues with the hawkish Federal Reserve after the bank started hiking interest rates.

Finally, the DJIA index recovered as investors focused on corporate earnings. Companies in the Dow published mixed quarterly results. For example, while Goldman Sachs had a good Q4, others like JP Morgan and Citigroup had a tough period. On the other hand, tech companies like Apple and Microsoft also did well during the quarter.

The best performing Dow Jones constituent was Chevron, whose stock price jumped by 40% as the price of crude oil jumped. It was followed by Travelers, America Express, Dow, Merck, Amgen, and Caterpillar.

On the other hand, the worst performer in the Dow in Q1 was Home Depot, as its stock crashed by 26.37%. This decline happened as investors priced in slow growth as people go back to work. It was followed by other retail-focused companies like Nike and Walgreens, which dropped by 19.40% and 16.80%. 3M, Goldman Sachs, JP Morgan, and Salesforce stock prices also retreated sharply.

Dow Jones forecast

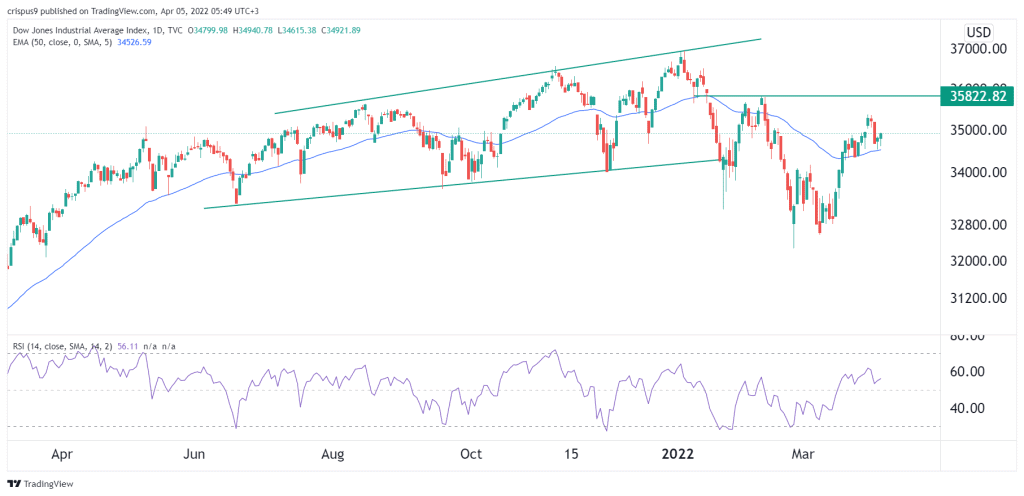

The Dow Jones has made a good recovery in the past few weeks and is trading slightly below $35,000. As the Fed gears to a more hawkish stance, it could lead to more volatility in the coming months. Nevertheless, it has managed to move slightly above the 50-day moving average and the lower side of the ascending channel. In addition, the Relative Strength Index has moved slightly above the neutral point at 50.

Therefore, the index will likely keep rising in Q2 as investors embrace the new normal of high rates and commodity prices. The next key level to watch will be at $35,822, which was the highest point on February 9th.