- Summary:

- The Dow Jones index is down sharply after a rise in US job openings gives the Fed room for an aggressive rate hike in its September meeting.

The Dow Jones index has fallen sharply this Tuesday after the latest job openings data added to market jitters of a more aggressive rate hike by the Fed when it meets on 25 September. The decline in the Dow Jones index comes as the JOLTS Job Openings data reveal a sharp increase in the number of job openings for July.

Job openings climbed from 11.04 million (an upward revision) to 11.24 million, beating the market expectations of 10.37 million job openings. The fact that job openings have climbed and not fallen as expected shows that the labour market still has more than enough room to accommodate any shocks from an aggressive rate hike in September.

As a result, bets for a third straight 75 bps rate hike on 25 September have gone up from 70% to 76.5%. This further puts pressure on the Dow Jones index, which was left reeling by Fed Chair Jerome Powell’s hawkish presentation at last Friday’s Jackson-Hole Symposium session.

All eyes would now be on Wednesday’s private sector employment data and Friday’s Non-Farm Payrolls data. Last month, the NFP data blew expectations out of the water even when the consensus showed an expectation of a labour market contraction. The Dow Jones Industrial Average is down 0.93% as of writing.

Dow Jones Index Forecast

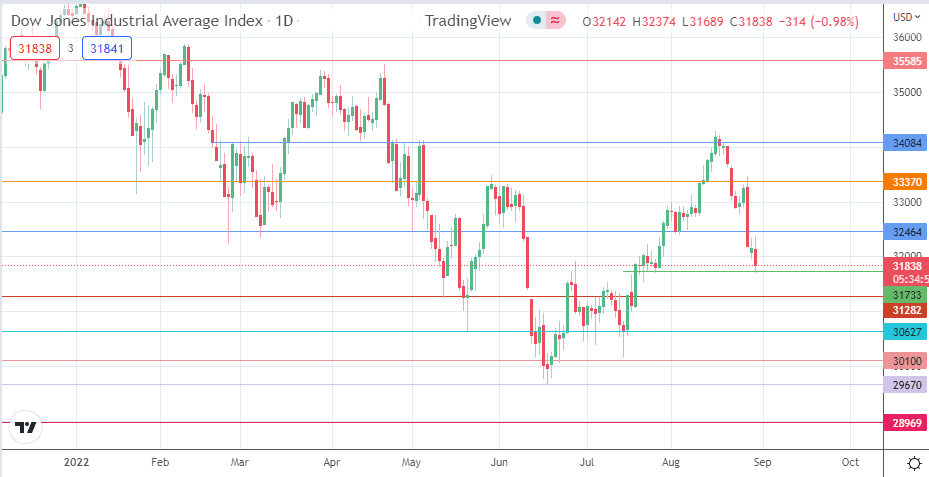

The Dow is testing support at 31733. A breakdown of this pivot, formed by the prior low of 22 July, sees the bears getting access to the 31282 support mark (12 May low, 5 July high). Further price deterioration brings 30627 into the picture (20 May and 15 July lows), leaving 30100 as another viable target to the south.

On the other hand, a bounce provides temporary relief to the bulls, with 32464 (2 August low) coming into the mix as an initial upside target if there is a solid bounce. A further retracement to the north brings in 33370 as a new target, leaving 34084 (25 February and 28 April highs) as a target that requires a huge advance to become a material target.

Dow Jones: Daily Chart