- Summary:

- Dow Jones Index dropped by 875 points in yesterday's trading session amidst increasing fears of inflation and market downturn.

The Dow Jones Index cratered by 876 points in yesterday’s trading session. The drop also marked the stock market plunge to bear market and saw Wallstreet investors become increasingly nervous about the possibility of even hasher markets depending on what the Fed will come up with to address the current inflation.

The recent reports of an 8.6 per cent inflation rate also surprised many economists who had expected a slight improvement from last month. The sharp inflation rate is also expected to make the Federal Reserve’s inflation control efforts harder.

Across the country, fears of a recession have also gripped the public, affecting their spending. Coupled with increasing fuel prices in the US and across the globe, investors have also been nervous about their investments,

In May, Federal Reserve Chair Jerome Powell raised rates by half a point to address inflation. However, with the recent reports showing even higher inflation rates, the rates are expected to go up again until the Fed is satisfied that inflation is under control. The raise is likely to see an improvement in the Dow Jones index. However, if the inflation rate continues rising, there is a high likelihood that we will see Dow Jones and the entire stock market continue to fall.

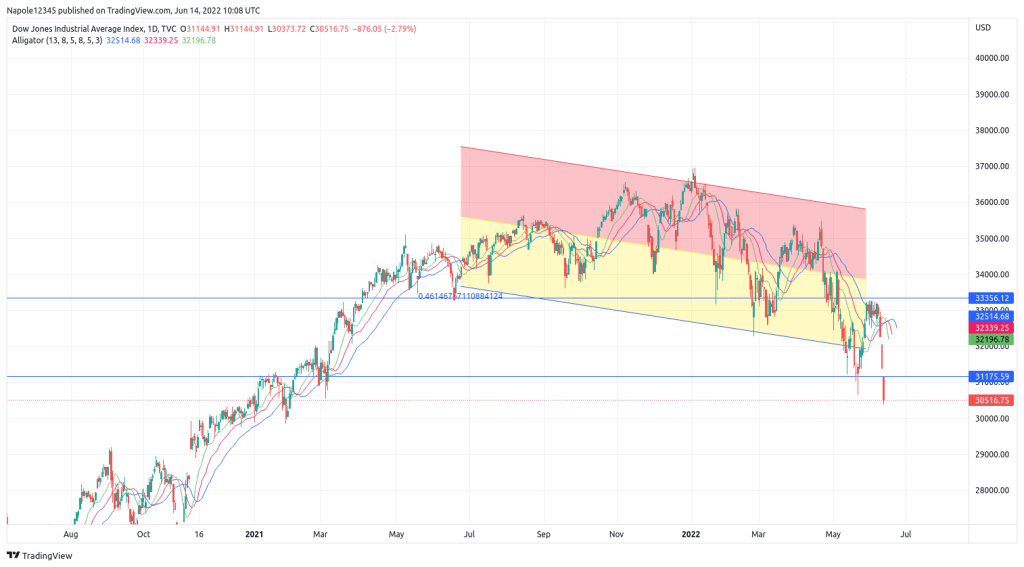

Dow Jones Index Analysis

The Dow Jones Index closed yesterday’s trading session with an 875-point drop ( 2.7 per cent price decline). The drop marked the fourth consecutive session that the index has lost in the markets.

I expect the current bearish trend to continue today and in the next few trading sessions. We will likely see the Dow Jones drop to trade below $30,000 for the first time since February 1, 2021.

The only reversal to the upside that is likely to happen depends on whether the rates will be raised. If raised, my bearish price analysis of the Dow Jones Index will be invalidated. It will also mean a possible bullish price reversal.

Dow Jones Daily Chart