- Summary:

- What is the outlook of the Dow Jones index ahead of this Thanksgiving? We explain the next key levels to watch in the near term.

The Dow Jones index futures have risen by more than 100 points on Monday. This jump has helped to offset some of the recent losses. Last week, the DJIA index declined in three of the final days. It is trading at $35,718, which is still lower than the all-time high of more than $36,500. The fear and greed index has dropped from the extreme greed level of 83 to the current 69.

Thanksgiving rally?

The Dow Jones index declined sharply last week as investors reflected on the strong economic data from the US coupled with the new Covid-19 wave in Europe. Analysts believe that the strong US data points to a more hawkish Federal Reserve while the new wave in Europe and China will have an impact on demand.

The Dow is now jumping mostly because of psychological reasons. Historically, the Dow Jones tend to rise during the Thanksgiving week. It has done well during Thanksgiving since the 1950s, according to analysts at CFRA. They told CNBC that:

“There’s a two-thirds likelihood the market is up on the day before Thanksgiving and a 57% likelihood the day after Thanksgiving, and a 71% likelihood that it’s up on Monday.”

At the same time, the rebound is also because investors are waiting for the upcoming Santa season. Historically, stocks tend to do well towards Christmas.

This week, the Dow Jones will react to several important earnings. On Monday, the top companies that will publish their results are Zoom Video, Urban Outfitters, and Spire. They will be followed by firms like Analogue Devices, HP, Best Buy, Dell, and Dollar Tree on Tuesday. On Wednesday, the companies to watch will be Deere and Futu Holdings.

Dow Jones forecast

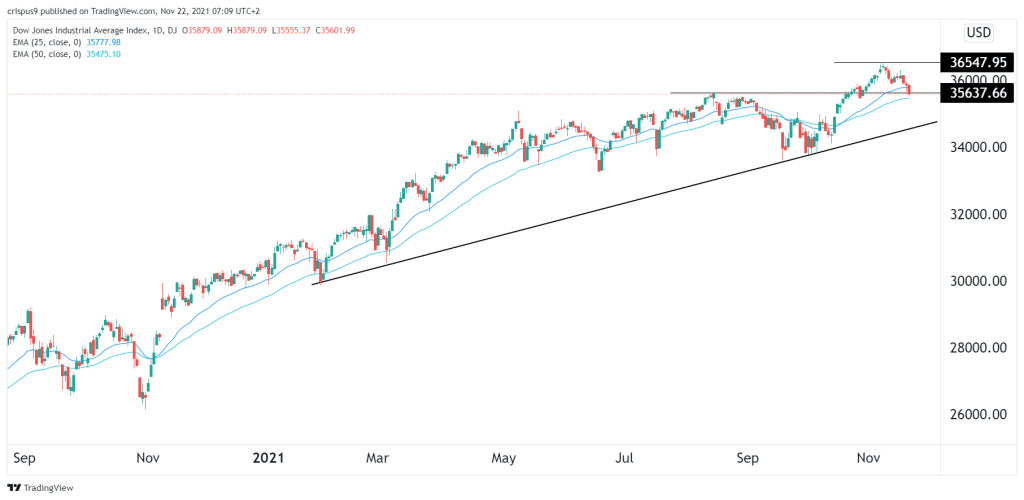

The daily chart shows that the Dow Jones index has been in a strong bullish trend in the past few months. Then, the index moved above the important resistance level at $35,637 in October. This was an important price since it was the previous all-time high. Now, the index has formed a break and retest pattern. This is usually a bullish sign.

Therefore, the index will likely resume the bullish trend as investors target the all-time high level at $36,547. This view will be invalid if the price drops below $35,000.