- Summary:

- Dow Jones trades above the 200 day moving average for the second day as bulls are in control. On the downside Dow Jones first support stands at 26,708

Wall Street indices started higher today with the Dow Jones adding 0.21% at 26,7835.63. The Nasdaq currently is trading 0.01% higher at 8,119, while the S&P 500 trading 0.18% higher at 2,981.77 as US and China plan to return to the negotiations table on October. On the macro data front United States Nonfarm Payrolls came in at 130K below expectations of 158K in August, the Average Hourly Earnings (year over year) came in at 3.2% beating forecasts of 3.1% in August. United States Unemployment Rate matched forecasts of 3.7% in August, the Labor Force Participation Rate came up to 63.2% in August from previous 63%.

The CBOE Volatility Index or fear index, is giving up 4.43% at 15.55 just to confirm the positive market mood.

Dow Jones getting a boost from Merck +0.81% Intel +0.66% and Verizon +0.59, on the other hand, Dow Inc is -1.25%, Walt Disney-0.25%, Microsoft -0.47% and 3M -0.23%.

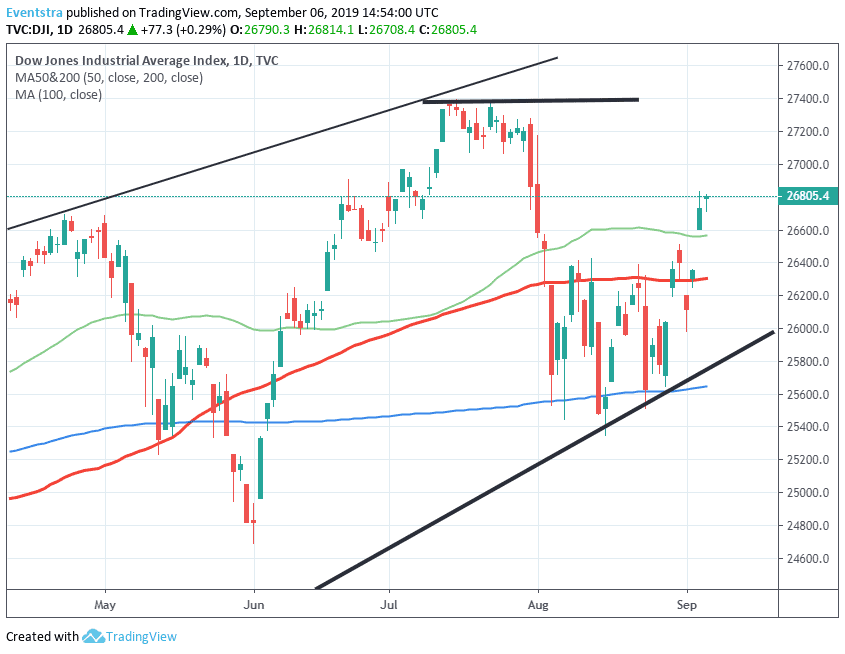

Dow Jones trades above the 200 day moving average for the second day as bulls are in control. On the downside Dow Jones first support stands at 26,708 today’s low and then at 25,567 the 200 day moving average. On the upside immediate resistance is at 26,804 today’s high and then at 27,273 the high from July 31st. The outlook for Dow Jones is bullish now, and only a break below 26,000 will question the positive momentum.

The European Indices trading mixed today, the DAX 30 is 0.35 percent higher at 12,168 while CAC 40 in Paris trades 0.10 percent higher at 5,598. The FTSE 100 is 0.04 lower at 7,267.