- Summary:

- The Dow Jones index has made a strong comeback in the past few weeks as most constituent companies published their results.

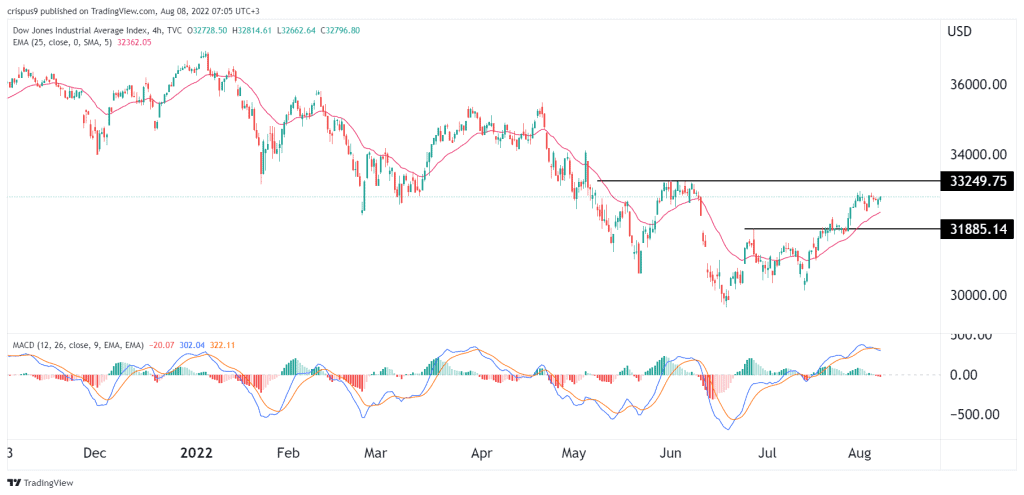

The Dow Jones index has made a strong comeback in the past few weeks as most constituent companies published their results. The blue-chip index rose to $32,803, which was the highest point since June 9th of this year. It has recovered by about 10% from its lowest point this year in a performance that mirrored that of the S&P 500 and Russell 2000.

Investors getting greedy

The Dow Jones has recovered significantly recently as signs emerged that investors are no longer extremely fearful. The fear and greed index has recovered slightly from less than 20 to the neutral point at 50. At the same time, the closely-watched VIX index has fallen to the lowest point in months. These are all positive signs for American stocks.

The DJI index has also recovered as investors predict that the worst is possibly over for American stocks. Recent earnings showed that many American companies did better than expected in terms of revenue and EPS. With margin pressure continuing, earnings growth was the slowest level since Q4 of 2020.

The key catalyst for the Dow Jones this week will be the upcoming US inflation numbers scheduled for Wednesday. Economists expect the data to show that inflation moderated slightly last month as gas prices retreated. These numbers will come a few days after the US published strong jobs numbers.

There will be several important corporate earnings this week that could have an impact on the Dow. Some of them include Barrick Gold, Palantir Technologies, Tanger Factory Outlet, and AECOM. Other notable firms that will publish are Avalara, Clover Health Investments, Upstart, Allbirds, and Aspen Technology.

Dow Jones forecast

The Dow Jones index has been in a strong bullish trend in the past few days. It has managed to move above the 25-day and 50-day moving averages and is approaching the important resistance point at $33,250. The MACD has moved above the neutral point while the price is above the important support point at $31,885.

Therefore, the index will likely continue rising as bulls target the resistance point at $33,250. A move below the support at $31,885 will invalidate the bullish view.