- Summary:

- The Dow Jones forecast for 2022 will depend on geopolitical events and monetary policy action from the Fed.

The US markets entered 2022 on the back of a remarkable rally that took off at the height of the pandemic in April 2020. Before then, the Dow Jones Industrial Average had lost nearly a quarter of its value between February and March 2020, in the wake of the onset of the COVID-19 pandemic.

However, this selloff did not last very long. Armed with the experience garnered from the 2008 global financial crisis, the US Federal Reserve led other central banks worldwide in crashing interest rates and initiating quantitative easing programs on a scale never seen before in history.

Backed by several stimulus packages and funding windows at near-zero interest rates, the Dow Jones Industrial Average quickly covered the initial losses suffered in February and March 2020. The Dow kept rising, and by 5 January 2022, it had posted new highs at 36,970. Soon after attaining this height, the Dow Jones average began a correction that continued for at least two months. This piece explains the trigger for this and provides the Dow Jones forecast for 2022 as the Fed’s actions and geopolitical events look set to be the biggest influences on price action.

Soaring US Inflation, The Fed and the Dow

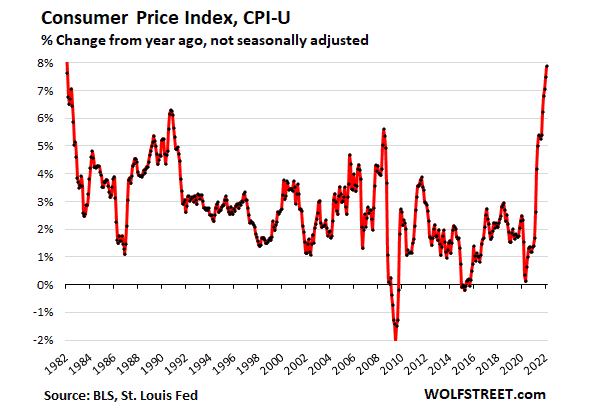

Pouring cheap money into an economy may seem chic at first, but it comes with a huge downside down the road. Too much money chasing fewer goods/services invariably leads to inflation. Consumer inflation in the US started to tick upwards in early 2021.

However, Fed chief Jerome Powell and some members of the board of the Federal Open Market Committee (FOMC) opined that the inflation was “transitory”, a result of supply chain issues that would soon resolve. It has been nearly a year since, and with consumer inflation at 40-year highs, several Fed members are pushing the rate hike rhetoric. The Fed started to cut off the cheap money in late 2021 as part of the so-called “tapering” exercise. This is expected to round up in March 2022.

Rising food, energy, and housing prices are also being followed by inflation in the US services sector, which has spiked by more than 4.8% on an annualized basis. The soaring inflation has driven bets of a 50 basis points hike in the Federal Funds Rate when the Fed meets on 16 March. The Fed had expected to start raising rates in 2023 and has done all it can to keep to this timetable. Unfortunately, its hands have been forced, and lift-off is coming a year earlier. The markets are also expecting at least 2-3 rate increases in the next year.

As cheap funds for trading in stocks started to dry up with the onset of tapering and long-term yields climb, the Dow Jones forecast is for the index to undergo a steep correction in 2022. There may be periods of rallies within the correction, but the Dow’s days of soaring without looking back may be over for now.

Geopolitics and Dow Jones Forecasts 2022

The invasion of Ukraine by Russia has added a geopolitical mix that will impact the Dow Jones and other global stock indices. Not only will an escalation push traders to adopt capital preservation and flight to safe-haven assets, but there could be a knock-on effect that could result from the fallout of massive sanctions placed on Russia.

Crude oil prices hit $138 per barrel of Brent crude on 7 March 2022. The rise in energy prices follows US sanctions placed on Russian oil. The Dow Jones forecasts on a sector-by-sector basis indicate that the rising energy prices are likely to benefit stocks of energy firms listed on the US30 index. Prices of gold and metals are also expected to rise as wary buyers shun sanctioned Russian mining companies for alternatives. US mining stocks could be the main beneficiaries. The conflict is still in its early stages, and a lot could still happen to make it a season of volatility for the Dow.

Dow Jones Forecast 2022

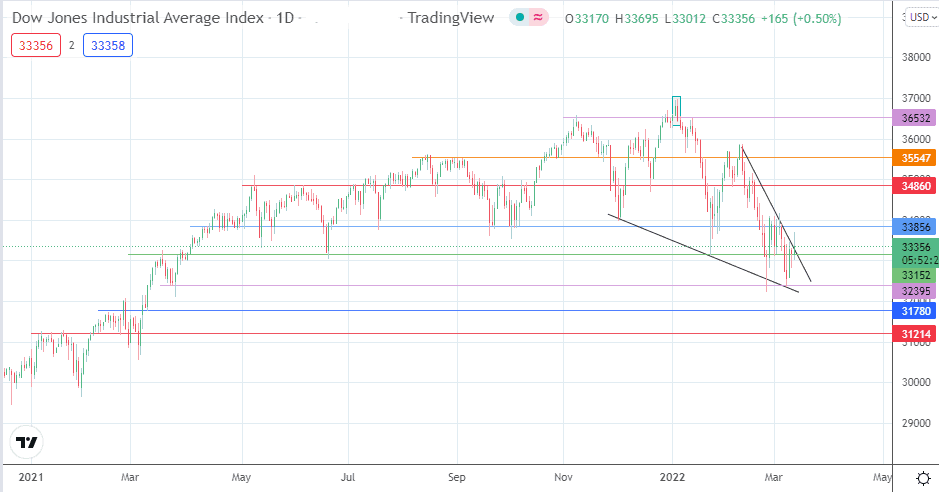

The break of the falling wedge and the 33152 resistance is on. If this is completed with a 3% penetration close to the upside, the potential for a measured move towards 35547 is heightened. This move must take out 33856 and 34860 to be attained.

On the flip side, a failure to achieve the required penetration, followed by a decline below 33152, postpones the pattern’s completion. The pattern is invalidated only when the bears have degraded the support level at 32395. This opens the door for a decline towards 31780, leaving 31214 as an additional target to the south.

Dow Jones: Daily Chart

Follow Eno on Twitter.