- Summary:

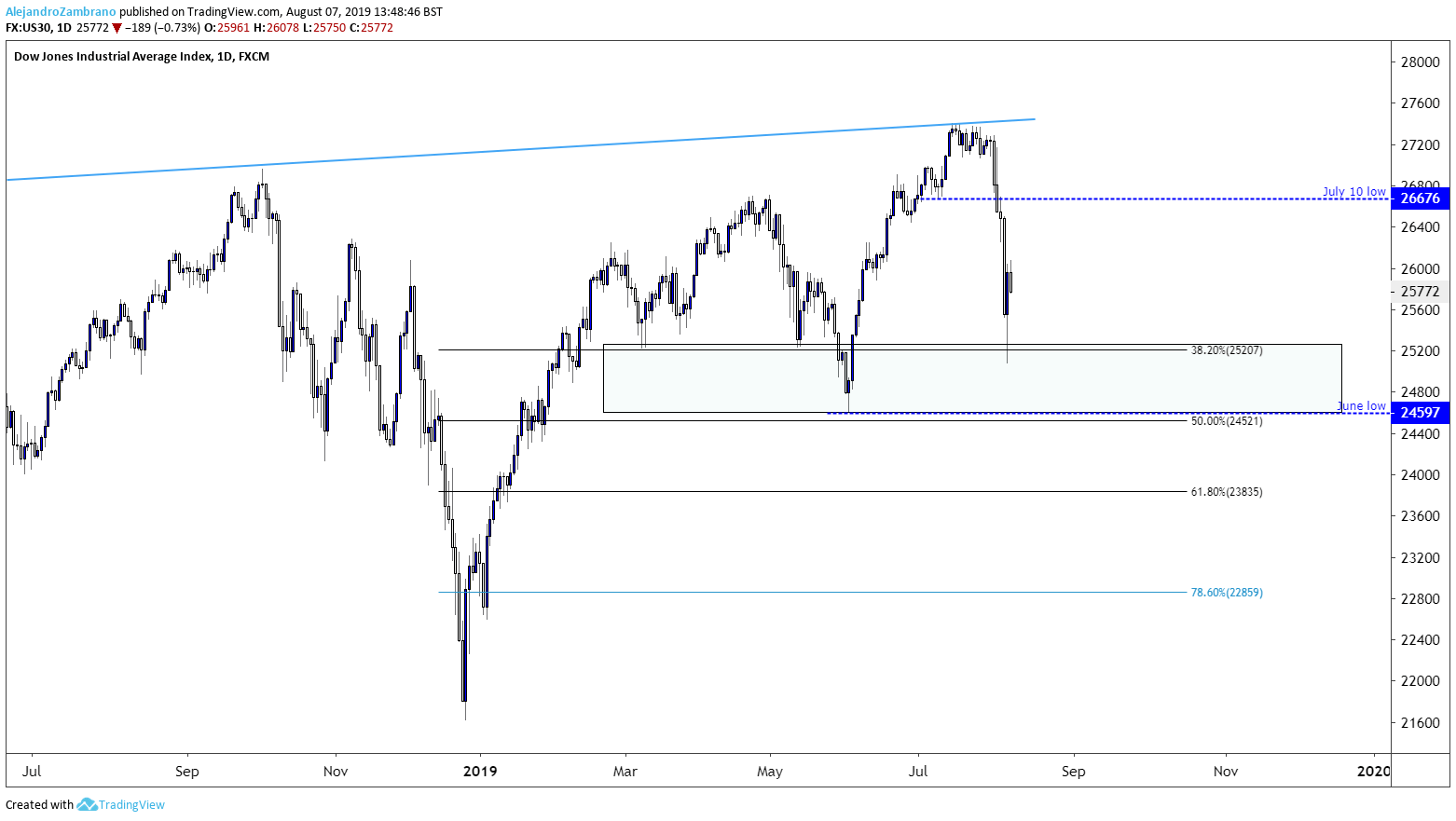

- Following last week’s slide, Dow Jones has stabilized and has so far managed to claw back a bit more than 38.2% of the slide from its 2019 high.

Following last week’s slide in the Dow Jones, the market has stabilized and has so far managed to claw back a bit more than 38.2% of the slide from its 2019 high. Looking beyond the global headlines of trade wars and rate cuts the technical trend of the Dow 30 remains upwards above the June low of 24597. As the trend remains upwards, it is not hard to understand why the market rose on Monday as the prices approached the June low. As for today’s trend, anyone’s guess is as good as mine. However, I can say that if the markets try to reach yesterday’s low of 25083, then bargain hunters could probably support the price for a test of the July 10 low at 26676. Around the July 10 low, the most bearish traders will probably try to short-sell with expectations that the price will challenge the June low once again.

If the price fails to receive support around the June low, the index might reach the 61.8% correction level at 23831 of the rally from the 2018 low to the 2019-high, followed by the 78% correction level at 22855.