- Summary:

- How has the performance of the dogs of the Dow Jones been in 2022? We explain the performance of some of these companies.

Dogs of the Dow refers to companies in the Dow Jones Industrial Average (DJIA) with the highest yields. These stocks have historically attracted investors interested in regular income from relatively safe companies. They also have a higher dividend yield than the index considering that the Dow has an average yield of 2.34%.

Dogs of the Dow performance in 2022

Most companies in the Dow Jones have a dividend yield that is higher than 2.34%. This is mostly because the index has crashed by more than 8% in 2022 because of the rising fears of higher interest rates. Investors are also worried about thinning margins as the price of commodities keeps rising.

As a result, only a handful of companies in the index are in the green this year. Some of them are Chevron, Dow, Amgen, Travelers, Merck, and Coca-Cola. Others that have risen are American Express, Walmart, and UnitedHealth.

The best-performing dogs of the Dow stock in 2022 is Chevron, as the stock has jumped by over 33% and reached its all-time high. The company’s shares have done well as investors react to the rising crude oil and gas prices. Oil has risen above $100 while gas prices have jumped to an all-time high because of the ongoing crisis in Europe. In addition, Chevron has a dividend yield of 5.44%.

The other top-performing dog of the Dow Jones is Dow Inc, as the company’s share price has risen by more than 18%. Moreover, this price action has happened even as the industry’s cost has risen substantially. As a result, the company had a strong performance in the most recent quarter.

Other dogs of the Dow that have done well are Amgen (11%), Merck (10%), and Coca-Cola (9.86%). On the other hand, the worst-performing stocks in this category are Verizon, Walgreens, and JP Morgan.

Dow Jones forecast

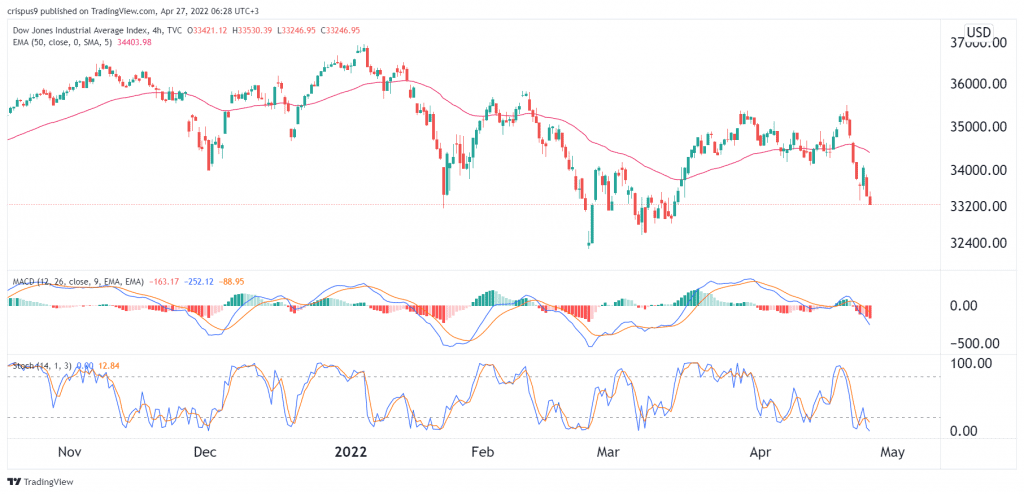

The daily chart shows that the Dow Jones index has been in a strong downward trend. It has dropped for the past two days and has been trading at the lowest level since March 15th. The shares have also moved below the 25-day and 50-day moving averages, while the Stochastic oscillator has moved to the oversold level.

Therefore, the index will likely keep falling as bears target the next key support at $32,400. A move above the resistance point at $34,000 will invalidate this view.