- Summary:

- The DocuSign stock price plummeted by more than 23% after the fallen angel published weak quarterly results. What next for DOCU?

The DocuSign stock price plummeted by more than 23% after the fallen angel published weak quarterly results. DOCU shares fell from $87 to $66 and are now hovering near the lowest level this year. They have fallen by over 78% from the highest point on September 7th in 2021, bringing its market cap to about $13 billion.

Why are DocuSign shares plunging?

DocuSign is one of the few companies that did well during the Covid-19 pandemic. At the time, most companies decided to implement work-from-home mandates. As a result, demand for e-signatures jumped sharply, making DocuSign one of the top beneficiaries of the trend.

Let’s put this into perspective. In 2019, DocuSign’s revenue was over $974 million. In 2020, this revenue jumped to more than $1.4 billion; in 2021, the firm’s revenue soared to over $2.1 billion. As its revenue jumped, the company managed to narrow its losses at a faster pace than expected. In 2020, its annual loss was over $208 million. Last year, it lost over $70 million.

Now, all this remarkable growth has started easing in the past few months. On Thursday, the company said its quarter revenue was over $588 million, which was about 25% from the same quarter in 2021. International growth was 43%, while the company added over 67k new customers. The management then downgraded their forward estimates and warned about future growth. The CEO said:

But we are experiencing many of the macro challenges that our peers are seeing, with inflationary concerns, a volatile workforce environment and general global instability.”

Will the DocuSign stock price recover? The company faces numerous challenges going forward. It is a company that offers one product and is facing significant competition from companies like Box, DropBox, and Adobe. The stock is also highly overvalued, considering that its stock will likely continue slowing in the coming years.

DocuSign stock price forecast

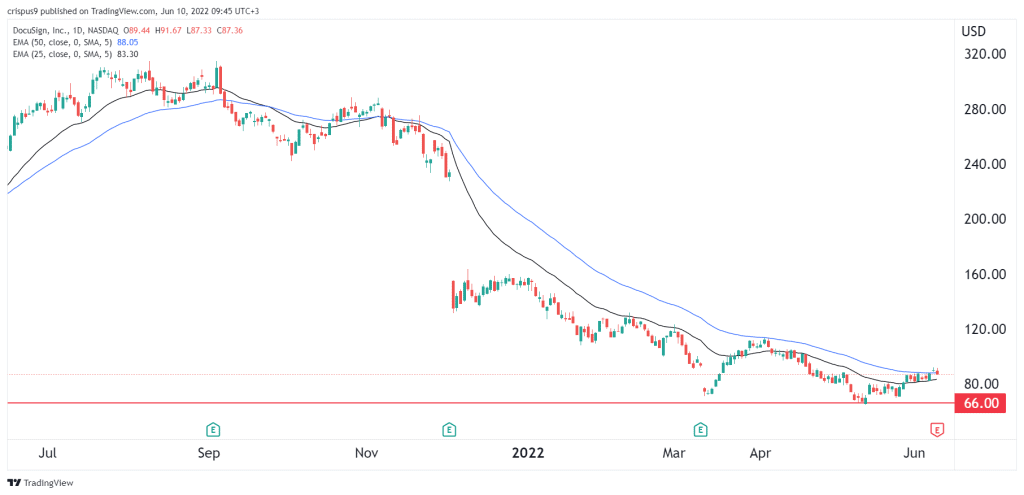

DocuSign share price has been in a strong bearish trend in the past few months. In December, the stock made a 40% down gap when it published weak results. The same happened in March when it also released weak numbers. Now, it has fallen to $66, which was the lowest level this year. It has also moved below the 25-day and 50-day moving averages.

Therefore, it is likely that the DOCU stock price will continue falling now that it has fallen below its key support level. The next key level to watch will be at $55. A move above the key resistance at $90 will invalidate the bearish view.