- Summary:

- Despite the corrective decline, analysts are still predicting a 12% upside potential for the Diageo share price.

The Diageo share price is down for the fifth day as the FTSE 100 index continues to see red this week. The correction in the Diageo share price comes from a pause in its whiskey sales business in some parts of India. This move could negatively impact the sales volume in that region.

Investors had been enjoying a fine run of form as the stock picked up pace 11 July low and shot up more than 12%. Some of this uptrend move was triggered by the company’s late July earnings figures. Diageo had seen its share price embark on a bull run which saw the stock push up after it reported a 22% yearly increase in attributable profits for its 30 June fiscal year-end. This bull run topped at the 3955p price mark, ending with an M pattern correction move that appears to have found a floor at the current price levels.

Despite the 5-day correction on the charts, several institutional analysts still provide a “Buy” rating on the stock, with a mean target price that constitutes a 12% upside potential. The stock is expected to face some headwinds as it pursues the analysts’ expectations. These will come from inflationary pressures, as higher prices could force a change in consumer habits and softer demand for its products. The Diageo share price is down 0.36% as of writing.

Diageo Share Price Forecast

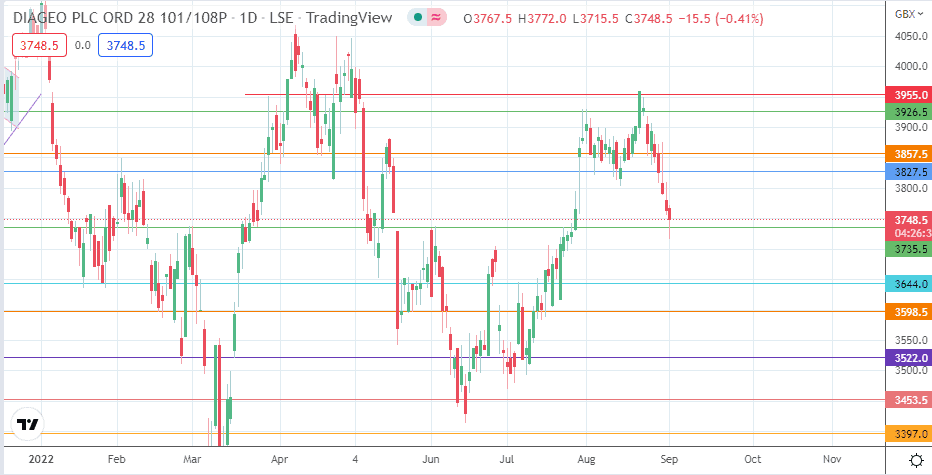

The bounce on the 3735.5 support completes the “M” pattern on the daily chart. This bounce has stalled the progress of the bears. If the bulls come in with a bounce at this level, 3827.5 (17 May and 3 August lows) becomes the immediate target. An advance beyond this point brings in 3857.5 as the next upside target, being the site of the previous lows of 4/22 April and 23 August, all working in role reversal as resistance barriers.

Only when this barricade is degraded can the bulls have a free pass to the 3926.5 resistance (4 April and 29 July highs). The 27 April high is located close to the 4000.00 psychological resistance level. Still, this barrier only becomes a valid target if the bulls take out the 3955.0 resistance formed by the prior highs of 29 March and 21 April 2022.

On the other hand, a capitulation of support at 3735.5 gives the bears unhindered access to the 3644.0 support level, the site of the previous 26 January and 27 June 2022. A further descent brings 3598.5 (25 May low) into the mix. Subsequent downside targets at 3522.0 (16 March and 24 June lows) and 3453.5 (14 June low) only become available if there is a price deterioration below the 3598.5 pivot.

Diageo: Daily Chart