- Summary:

- Diageo share price is on the brink of touching off new highs as new carbon-neutral Chinese distillery is set for construction.

- Ground-breaking for new $75million plant in China occurs.

- Plant is to be a carbon-neutral facility, producing whiskey for the Chinese market.

- Diageo share price close to new record highs after great start to November.

The Diageo share price continues to push to the upside as the company has keyed into the new climate change initiatives being pushed by world leaders at the Glasgow conference. To this end, the company is to build a new $75 million carbon-neutral distillery in China.

The plant’s groundbreaking ceremony took place at Eryuan County, in the Chinese Yunnan Province. The new plant is to produce the company’s first single malt whiskey of Chinese origin to serve China, which is the world’s biggest alcoholic beverage market. Construction is expected to commence early next year.

Investors appear to be pleased with the new initiative, taking the Diageo share price to the brink of new record highs in what has been an outstanding year for the stock.

Diageo Share Price Outlook

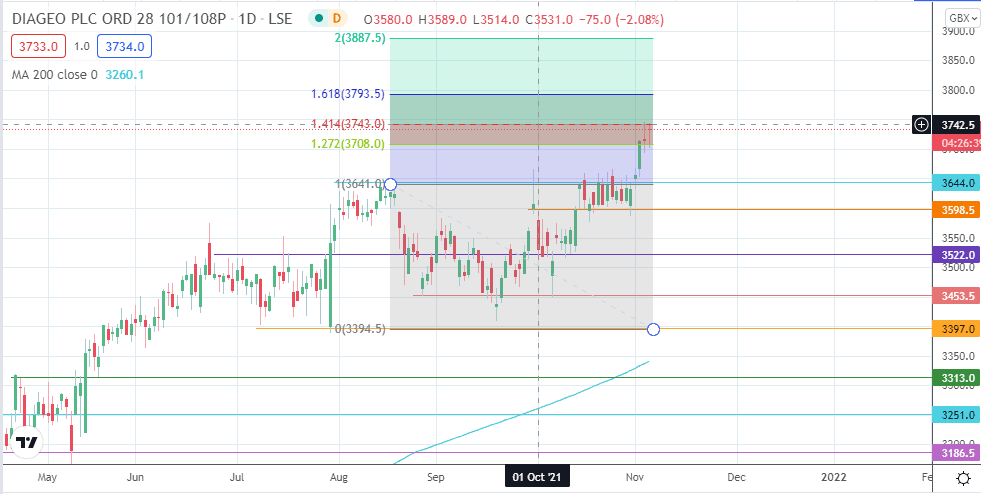

Having broken the 3644.00 resistance, Diageo is now trading in record territory above 3731.0. The price action has met resistance at the 141.4% Fibonacci extension level at 3743.0. A break above this level continues the uptrend, targeting 3793.5 (161.8% Fibonacci extension) initially. 3887.5 is an ambitious target to the north (200% Fibonacci extension).

On the flip side, a retreat from the current resistance targets 3644.0 initially (18 August and 14 October highs), with 3598.5 and 3522.0 serving as additional price targets to the south. If the corrective decline continues, 3453.5 becomes another downside target.

Diageo: Daily Chart

Follow Eno on Twitter.