- Deutsche Bank's Aviva share price target gives the stock a 25% upside potential despite its recent 25% slump.

The Aviva share price has had a modest open to the trading week, putting on a 1.18% gain as the stock tries to recover from a major shock it experienced last week. The Aviva share price fell 26.52% last Monday ahead of its earnings results for the 1st quarter of 2022.

The sentiment around the stock was captured in a note by Deutsche Bank, which has a negative outlook based on these numbers. Deutsche Bank analysts said the figures seen in the quarterly results were a “bit worse” than they had hoped.

The company’s general insurance business was hit by £70mln costs, sending the combined operating ratio (COR) from 96.4% to 90.6%. However, the bank retained its overall BUY rating and kept its 520p Aviva share price target, citing support from substantial valuation due to an expectation of a dividend yield of 8%.

Investment bank UBS also retained its BUY rating, while Jefferies has a “HOLD” recommendation with a 460p price target. These price targets still give Aviva’s share price a significant upside potential from the current price. Recall that the recent steep fall in the stock’s price came after a chaotic shareholders’ meeting in which there were allegations of sexist remarks directed at Aviva CEO Amanda Blanc.

Aviva Share Price Outlook

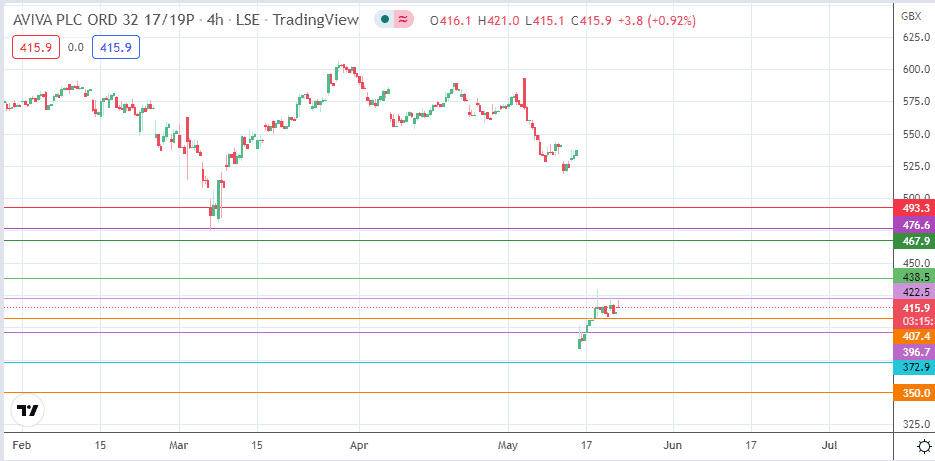

The immediate resistance lies at 422.5 (16 November 2020 and 20 May 2022 highs). The bulls need to break this level to secure access to 438.5 (17 December 2020 high) as the next target. Above this level, additional resistance comes in at 467.9 (4 March 2020 and 13 January 2021 highs) and 476.6 (15 February 2021 high). Only a break of this level and attainment of the 493.3 resistance (19 July 2021 low) covers the downside gap.

On the other hand, rejection at 422.5 opens the door for a potential downward move which retests the 18 May 2022 low at 407.4. Below this level, additional support comes in at 396.7 (7 October 2020 and 17 May 2022 highs) and 372.9 (7 April 2020 high and 9 September 2020 low).

Aviva: 4-hour Chart