- Summary:

- The Deliveroo share price popped by more than 3% on Wednesday after the company published a strong trading statement.

The Deliveroo share price popped by more than 3% on Wednesday after the company published a strong trading statement. The ROO stock jumped to 300p, which was about 15% above the lowest level this month.

Deliveroo guidance

Deliveroo is a leading food delivery company that went public this year in one of London’s worst initial public offering. It is backed by Amazon and has been rapidly changing its business model. In the past few months, the company has expanded its services to include drug delivery using a partnership with Boots.

The company has also moved into grocery deliveries. Most importantly, it won a landmark case in London that sought to classify its riders as employees. Still, like Uber and Lyft, the company is facing a major challenge finding workers. As such, the company has been forced to increase its prices as the cost of doing business increased.

In a statement published on Wednesday, the firm said that it expects that its gross transaction value will rise by between 60% and 70% this year. This was substantially higher than the previous forecast of between 50% and 60%. The value increase to 1.6 billion in the third quarter while the average size of orders fell by 4%. So, what next for the Deliveroo share price?

Deliveroo share price forecast

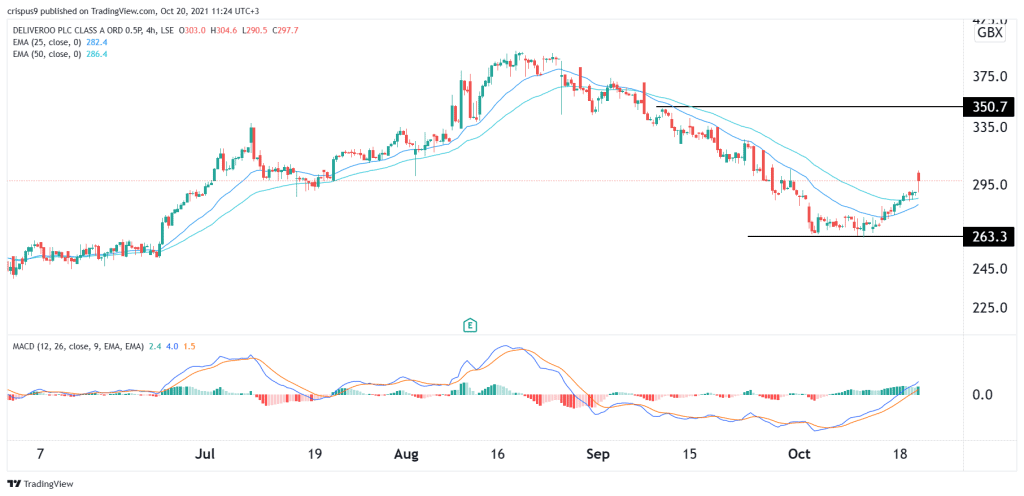

The four-hour chart shows that the Deliveroo share price has been in a major bearish trend in the past few weeks. The stock dropped by more than 33% from its highest level in August and the lowest level this month. On a positive side, it seems like the stock has formed a double-bottom pattern, which is usually a positive view.

Meanwhile, the ROO share price has crossed the 25-period and 50-period moving averages, which is a positive thing. The MACD has also moved above the neutral level.

Therefore, the stock will likely keep rising as bulls target the next key resistance level at 350p. On the flip side, a drop below the two moving averages will invalidate the bullish view.