- Summary:

- Deliveroo's share price has been struggling in the markets for the past two weeks. After almost hitting the monthly price high of 101.

Deliveroo’s share price has been struggling in the markets for the past two weeks. After almost hitting the monthly price high of 101 on August 16, the prices started to plummet in the late hours of the session. Since then, the Deliveroo share price has gone down by 20 per cent.

The drop in the past two weeks came amidst reports that the company had widened its first-half losses and the company was planning on exiting the Netherlands market. According to reports released earlier this month, just before the current bearish push, the company was found to have had a pretax loss of £147.3 million in the first six months of the year.

These losses were up by 54 per cent year-over-year. The company attributed the losses to increased spending on marketing and overheads. However, other metrics of the company improved. This included the overall sales, which was up by 7 per cent year-over-year, totalling £3.6 billion.

The plans to exit the Netherlands also followed similar plans that had been executed in the past months when the company retreated from the German and Spanish markets. The decision and the ongoing execution of the plan may be having an impact on the current Deliveroo share prices and resulting in its share prices falling.

Deliveroo Share Price Analysis

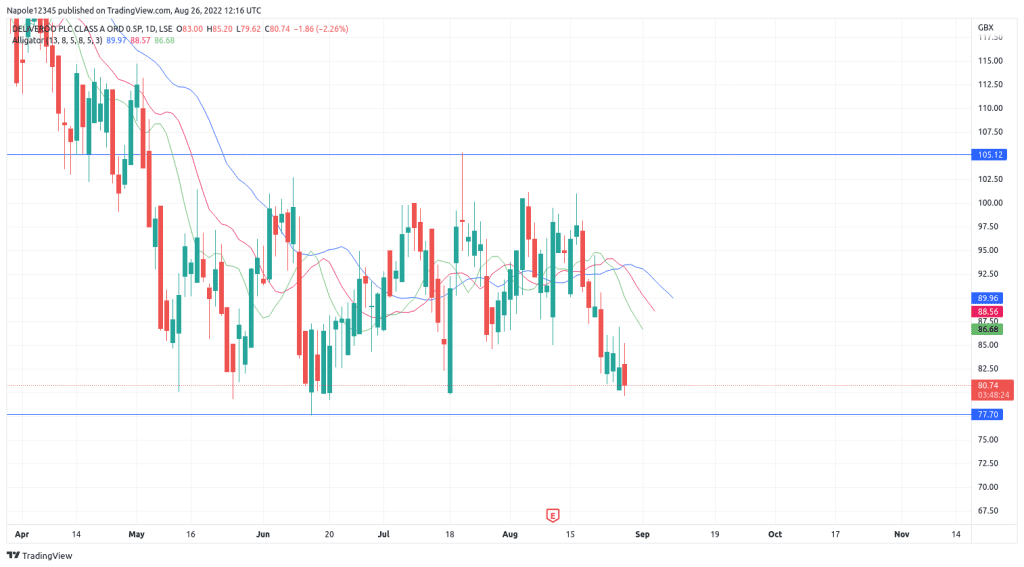

Looking at the chart below, Dliveroo is still in a strong bearish market, despite the past three days closing with a market gain. Today, the Deliveroo share price is down by 2 per cent. The trend also looks aggressively bearish, with a high likelihood of closing even lower.

In the next few trading sessions, I expect the current push to the downside to continue. The share prices will finally rade below the 80p price level. There is a high likelihood that the prices may fall as far back as to trade below the 77.7 demand level. A trade above 85p will invalidate my bearish analysis.

Deliveroo Daily Chart