- The Decentraland price remains under pressure on Tuesday as crypto investors become increasingly risk-averse.

The Decentraland price remains under pressure on Tuesday as crypto investors become increasingly risk-averse.

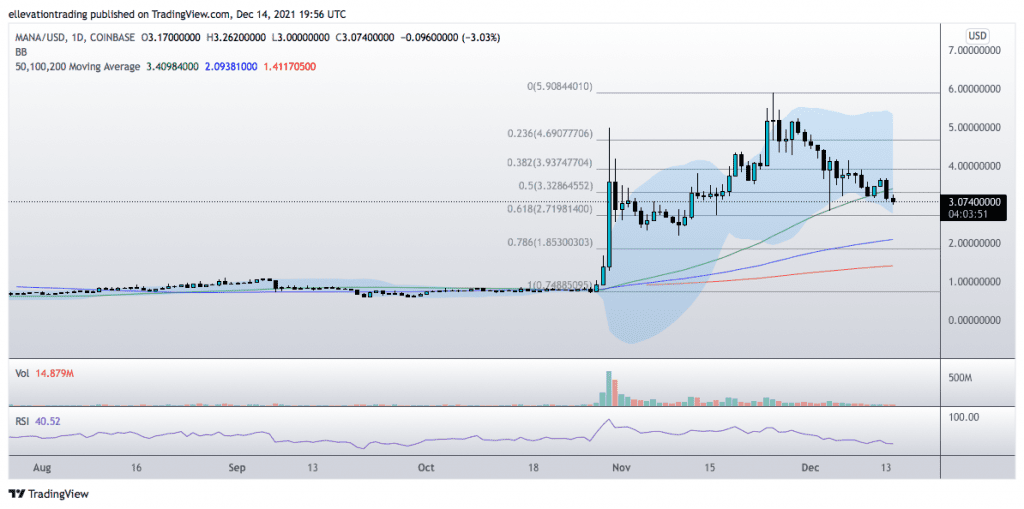

Decentraland (MANA) was a star performer when Metaverse-related cryptos surged in November. The gaming token saw a seven-fold increase to a record price of $5.914 and a $7.75 billion valuation, making it one of the world’s biggest cryptocurrencies. Since then, MANA has retraced over 50% on profit-taking and central bank tightening concerns. But despite the pullback, the token has gained over 300% since the last week of October.

Later today, the FOMC will deliver its final interest rate decision of 2021, which could create heightened volatility. The consensus is the US central bank will announce a more aggressive reduction in asset purchases to temper runaway inflation. Whilst this is broadly priced-in, a surprise interest-rate hike isn’t. In that event, risk assets, including cryptos, could be in for a bumpy ride.

MANA Price Forecast

The daily chart shows the Decentraland is trending lower surprisingly uniformly. MANA is currently beneath the 50-Day Moving Average at $3.458, the first resistance level. Whilst below the market, the 100-DMA at $2.116 and the November 10th low of $2.201 support the price.

Todays FOMC meeting could swing the balance either way for Decentraland. On that basis, I am reluctant to make a MANA price prediction. However, I am confident that volatility will factor in today’s price action. Therefore, traders should prepare for challenging conditions.

Decentraland Price Chart (Daily)

For more market insights, follow Elliott on Twitter.