- Summary:

- The German Dax benchmark closed yesterday 0.23 percent lower to 11,953 despite dovish ECB. The ECB's governing council extended the forward guidance

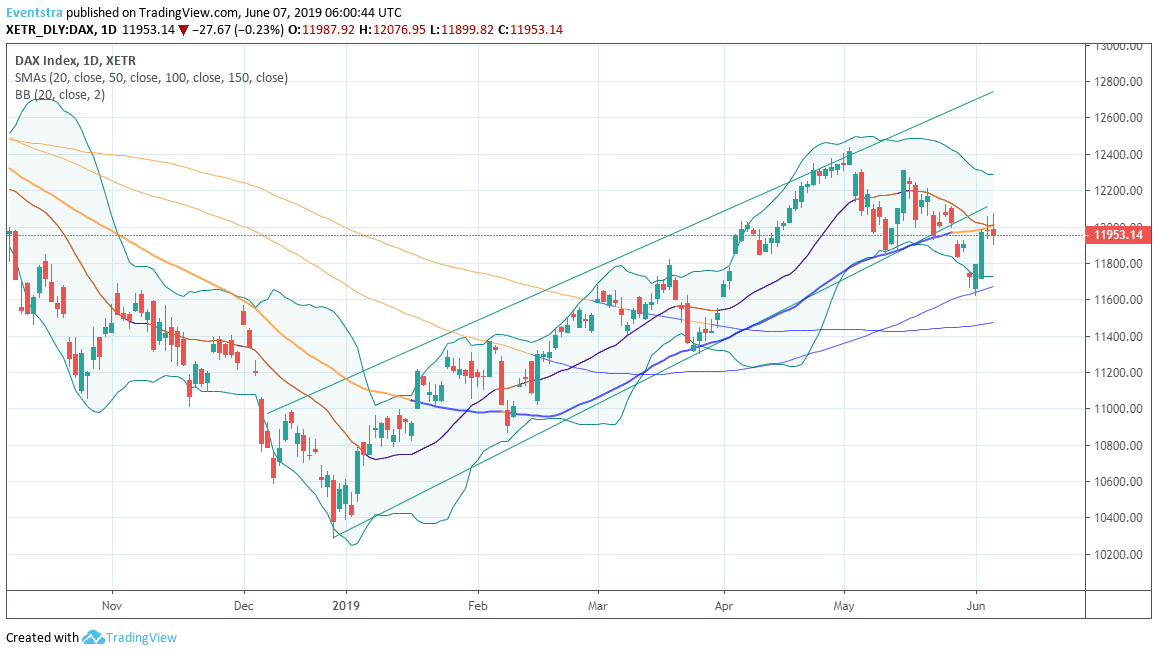

The German Dax benchmark closed yesterday 0.23 percent lower to 11,953 despite dovish ECB. The ECB’s governing council extended the forward guidance by another six months, meaning that rate hikes were no longer seen rising until “at least” mid-2020. Traders following news from the U.S. – Mexican trade conflict, as US President repeat a previous threat to impose tariffs of up to 25% on goods from Mexico. The key event today is coming from the other side of the Atlantic at 12:30GMT, the non-farm payrolls data will drive the markets today. Analysts expect that the US economy added 185K jobs in May and the jobless rate is forecasted at 3.6%.

DAX has already lost 700 points recently it would be normal and healthy for a market to retrace some of those losses. The German major index has broken through the floor of a rising short term trend the last 10 trading sessions and still trades below. This indicates a slower rising rate, or the start of a consolidation phase. DAX has given positive signal from inverse head and shoulders formation by a break up through the resistance at 11344. A rise to 12500 or above is possible. The index immediate support stands at 11770, which may attract buyer’s attention. On the upside the first resistance is at the 50 day moving average at 12,000 while more offers will emerge at the upper bound of the Bollinger Bands at 12,289.