- Summary:

- The German Dax benchmark index rallies after dovish comments by ECB President Mario Draghi, who said that if the Eurozone economy slows and the ECB

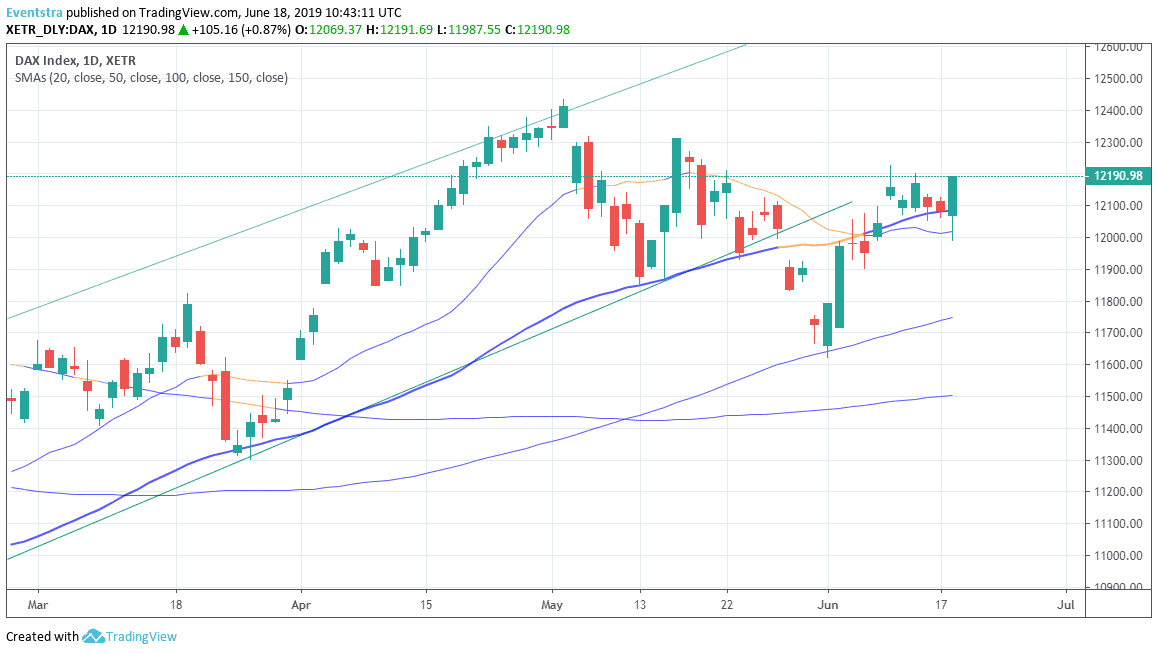

The German Dax benchmark index rallies after dovish comments by ECB President Mario Draghi, who said that if the Eurozone economy slows and the ECB inflation target is threatened, “additional stimulus will be required”. He cited global trade war as one of the key factors weighing on exports, particularly manufacturing, and said that the bank’s asset purchase program “still has considerable headroom”. Markets expected that interest rates in EU to remain at current levels at least through H1 2020. Later this week, both the Fed and Bank of Japan will meet, and, with markets pricing in ever-greater chances of a Fed rate cut that some believe could arrive as soon as Wednesday.

DAX is adding 0.76 percent at 12,177 breaching above all major hourly moving averages, DAX has given positive signal from inverse head and shoulders formation by a break up through the resistance at 11344. On the upside the first resistance is at 12,301 the high from May 16 while more offers will emerge at 12,440 the high from May 3rd. On the downside the index immediate support stands at 12,000 the 20 day moving average, while 11,748 the 100 day moving average may attract buyer’s attention.