- The DAX index has been in a strong downward trend this year as concerns about the European economy and the aggressive European Central Bank

The DAX index has been in a strong downward trend this year as concerns about the European economy and the aggressive European Central Bank (ECB) continue. It has dropped by more than 20% this year and is hovering at the lowest level since November 2 2020. In total, it has fallen by 24% from the highest level this year.

The DAX index continued its sell-off after the crisis in Ukraine continued. On Monday, Russia launched tens of missiles to key Ukrainian cities after it blamed Ukraine for attacking the bridge that connects Crimea to Russia. As a result, analysts believe that the conflict will continue for a while, which will lead to more European economic weakness in the coming months.

The DAX index retreated ahead of the upcoming American bank earnings season. Big American banks like JP Morgan, Wells Fargo, and Citigroup will start delivering their results this week. Historically, these results tend to have an impact on global equities. Analysts expect that these banks saw improved results, helped by the relatively high-interest rates.

Trade index with a reliable broker

Most DAX index constituents have been in a strong bearish this year. Zalando, Vonovia, Puma, Adidas, and Fresenius are the worst-performing stocks in the index after they dropped by more than 50% this year. The only companies in the green are Deutsche Boerse, Beiersdorf, Deutsche Telekom, RWE, and Bayer. Bayer share price has risen this year because of the company’s success in defending its Roundup claims in the US.

DAX index forecast

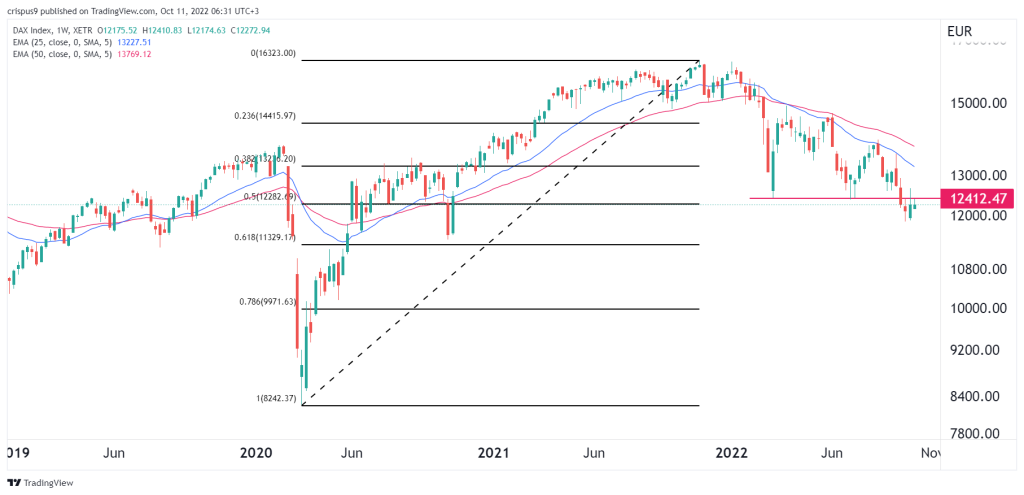

The weekly chart shows that the DAX 40 index has been in a steep sell-off this year. It managed to move below the important support at €12,412, which was the lowest level on March 7. It also dropped below the 50% Fibonacci Retracement level. Further, the index moved below all moving averages while oscillators continued dropping.

Therefore, at this stage, the outlook of the index is bearish, with the next key level to watch being at €11,329, which is along the 61.8% Fibonacci retracement level. A move above the resistance at €12,500 will invalidate the bearish view.