- Summary:

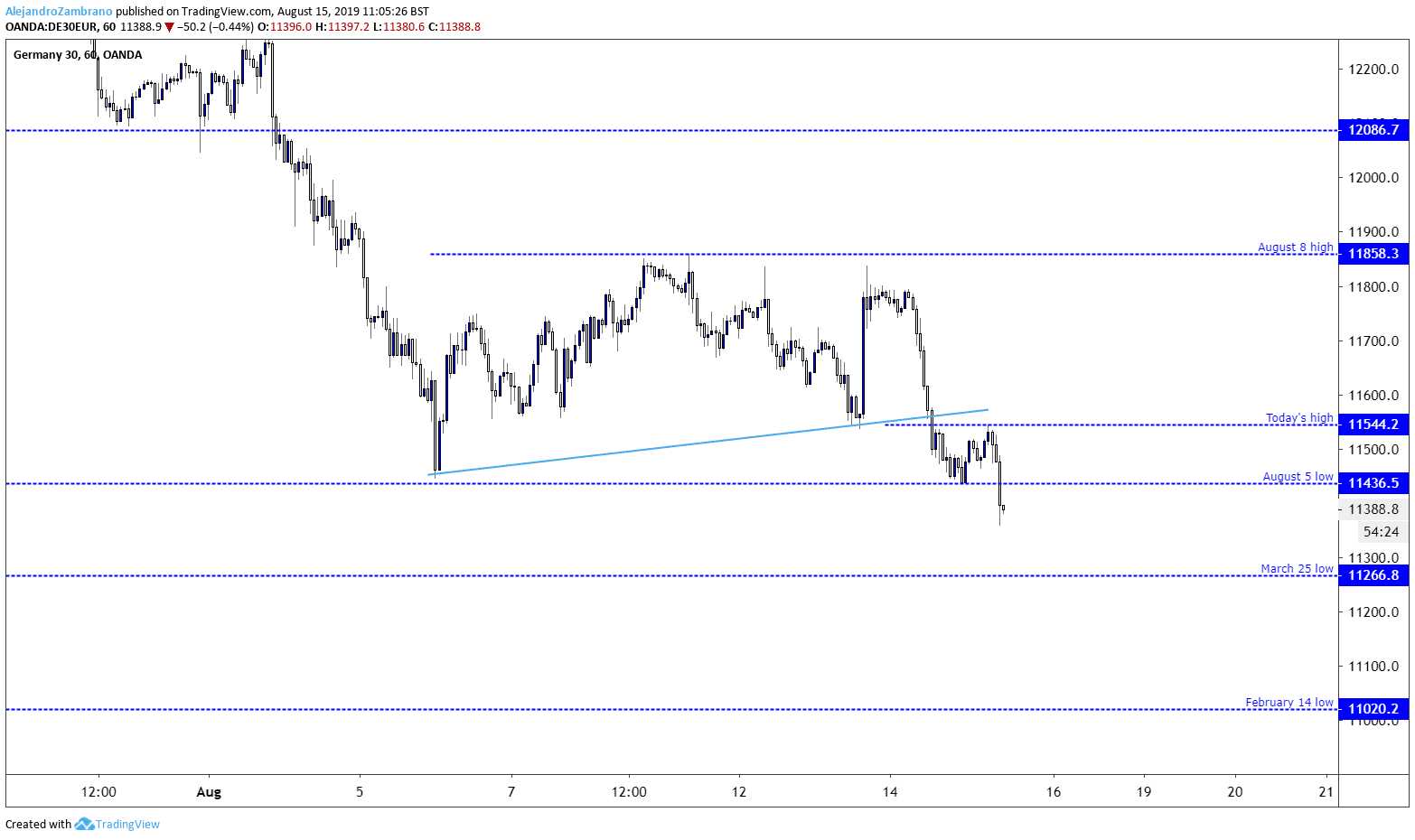

- The DAX index just slid below yesterday's low and likewise the August 5 low of 11436 on recession fears in German and Europe.

The DAX index just slid below yesterday’s low and likewise the August 5 low of 11436. The next support level is the March 25 low of 11266, followed by the February 14 low of 11020. The short-term trend in the DAX index should be downwards as long as the price trades below today’s high of 11544.

Fears of a recession in Europe is feeding the selling. Yesterday, the Federal Statistical Office of Germany reported that 2Q GDP declined by 0.1%. From the same period last year, GDP increased by 0.4%. Leading indices like the ZEW and Sentix index for Germany are in free fall and suggesting that the German economy should continue to be under pressure. The Sentix index for the Euro area is also negative like the German one, and it is accelerating its downtrend. The slowdown in the German economy is mirrored by the UK economy, where the economy has declined due to Brexit fears, and general economic slowdown due to trade wars.

Today’s high of 11544 is important for the short-term trend in the DAX index, while the August 8 high is important important for the multi-week trend.