- Summary:

- DAX index trading 1.99% lower at 11,515 as investor’s got hit by terrible German and EU macro data. The German economy shrank by 0.1% in the second quarter

DAX index trading 1.99% lower at 11,515 as investor’s got hit by terrible German and EU macro data. The German economy shrank by 0.1% in the second quarter from the previous quarter as expected. Eurozone GDP growth slowed from 0.4% during the first quarter to 0.2% in the Q2, 2019. Yesterday, the German ZEW Economic Sentiment came in at -44.1 below expectations of -28.5 for August, the Current Situation came in -13.5 also below expectations of -7 in August.

China’s year-on-year rate of growth in industrial production had slowed from 6.3% in June to only 4.8% for July below consensus expectations of 6.0%. Poltical turmoil in Italy also weighs on traders sentiment as Prime Minister Salvini aiming for snap election as early as October.

DAX index makes today fresh two month lows, dragged by Infineon AG -4.95%, Thyssenkrupp AG -4.89%, Deutsche Bank -4.86% and Covestro -3.16%. On the other hand, RWE AG is 0.39% higher while Beiersdorf AG is 0.19% higher.

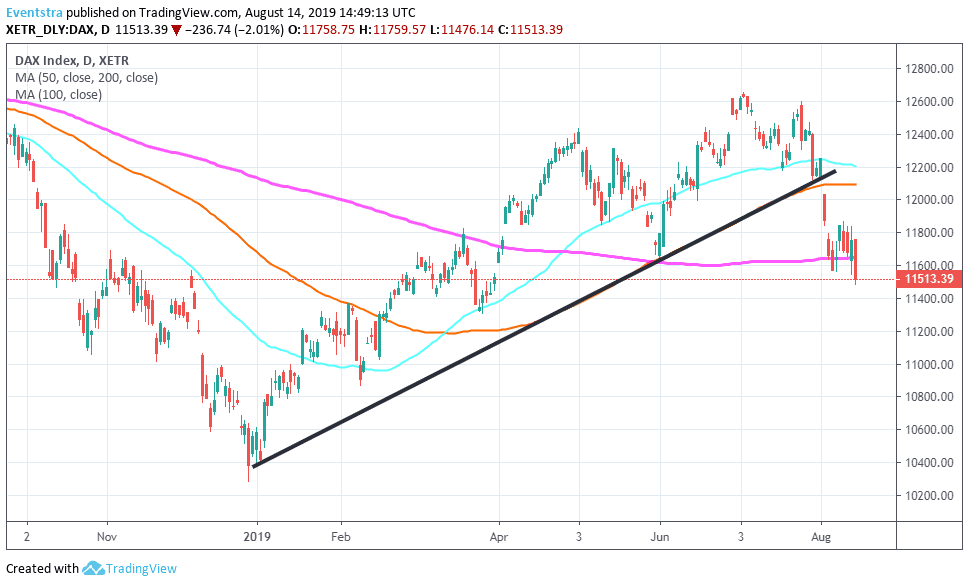

DAX negative momentum accelerates after the index broke below the 200 day moving average at 11,648 as bears are ruling the game. Immediate support for the DAX index stands at 11,386 the low from March 27th while extra bids will emerge at 11,000 round figure. On the upside immediate resistance stands at 11,759 today’s high and then at 12,094 the 100 day moving average.

In London the FTSE 100 gives up 1.32% at 7,155, while CAC 40 is 1.83% lower at 5,265. In Wall Street, Dow Jones is 1.73 percent lower at 25,824 while the S&P is 1.76 percent lower at 2,875 while Nasdaq is 2.00% lower at 7,851.