- Summary:

- DAX index continues higher adding 0.86% at 11,750 as investor’s digest the latest developments in US – China trade war and the weakness of Yuan as PB of

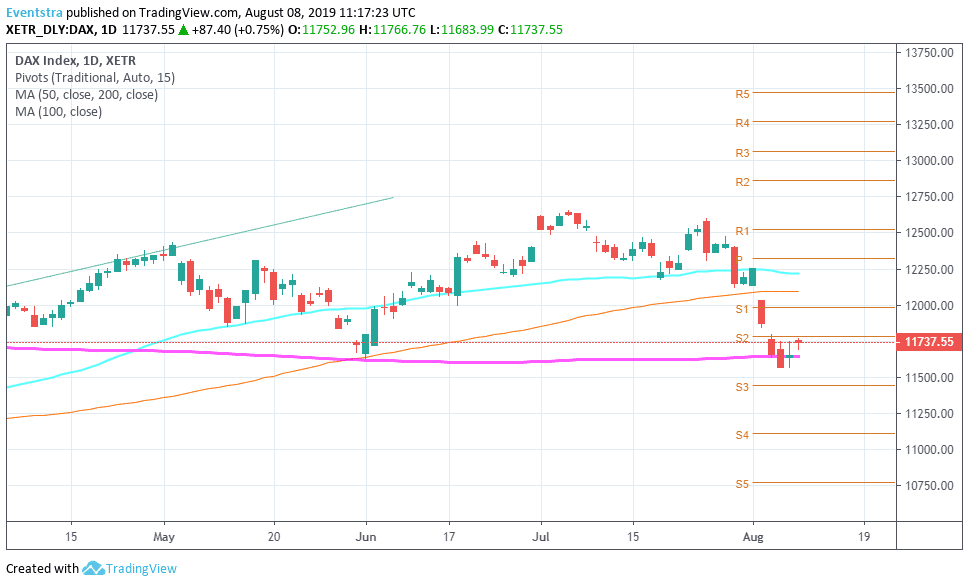

DAX index continues higher adding 0.86% at 11,750 as investor’s digest the latest developments in US – China trade war and the weakness of Yuan as PB of China fixed the yuan (USDCNH) above the 7.00 level for the first in a decade. DAX index rebounds from two month lows, as the index tested successfully the 200 day moving average at 11,641. Covestro AG is leading with gains of 3.43% while Thyssenkrupp AG adds 3.19% and Merck KGaA gaining 2%. On the other hand, E.ON SE gives up 2.33% while adidas AG is 1.33% lower.

Recent disappointing macro news support a dovish tone from ECB as poor economic data may push the European Central Bank to proceed with further stimulus to support the EU economy in September.

DAX momentum is negative after the index broke below the 12,000 mark and the 100 day moving average. Immediate support for the DAX index stands at 11,641 the 200 day moving average while extra bids will emerge at 11,000 round figure. On the upside immediate resistance stands at 11,766 daily high and then at 12,094 the 100 day moving average.

In London the FTSE 100 index adds 0.13% at 7,208, while CAC 40 is 1.20% higher at 5,329. In Wall Street, the futures also trading higher, the Dow futures are 0.12 percent higher at 25,970 while the S&P futures are 0.24 percent higher at 2,887 and the Nasdaq is 0.41% higher at 7,584, signaling a positive start for U.S. equities.