- Summary:

- DAX index and European indices started mixed the week as investor’s attention turns to Fed’s decision later this week and a new round of

European indices started mixed the week as investor’s attention turns to Fed’s decision later this week and a new round of talks between the China and US. As of writing, the DAX index trading 0.07 percent lower at 12,411 giving up early gains. Macro news from Spain reported earlier showed that the year-on-year rate of harmonised consumer price gains in the euro area’s fourth largest economy picked up to 0.7%, after a rise of 0.6% in the month before. The Retail sales in Spain, increased by 2.4% year-on-year in June, which was unchanged from the previous reading; The worse macro news support a dovish tone from ECB as poor economic data may push the European Central Bank to proceed with further stimulus to support the EU economy in September.

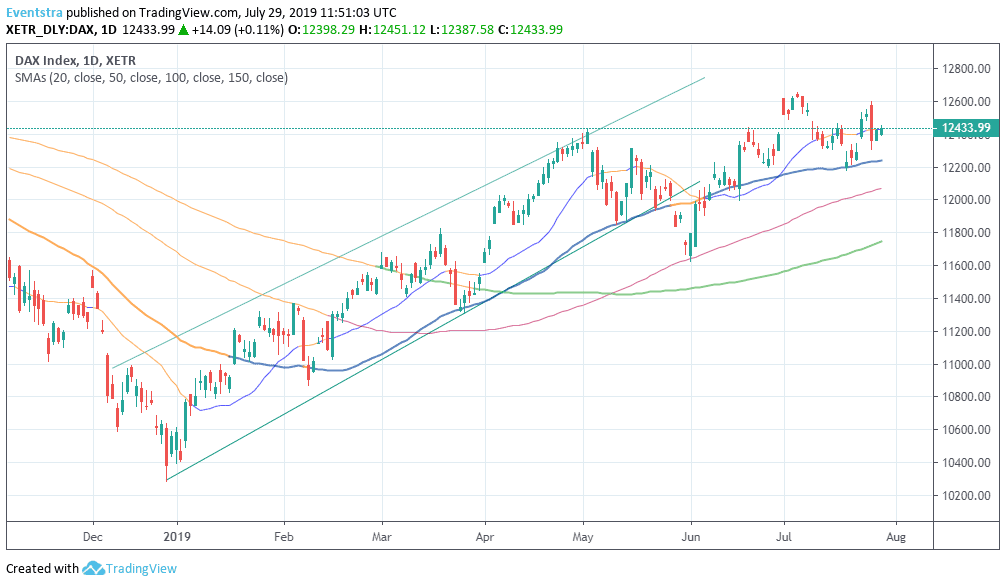

DAX momentum stays positive as the index trading above all major daily averages. The low interest rates environment support equities across the globe. Immediate support for the performance index stands at 12,240 the 50 day moving average while extra bids will emerge at 12,068 the 100 day moving average. On the upside immediate resistance stands at 12,451 daily high and then at 12,640 the high from July 4th.

In London the FTSE 100 index outperforms adding 1.31% at 7,648, while CAC 40 is 0.16% lower at 5,601. In Wall Street, the futures trading mixed, the Dow futures are 0.01 percent lower at 27,146 while the S&P futures are 0.06 percent lower at 3,02 and the Nasdaq is 0.09% lower at 8,012, signaling a slightly negative start for U.S. equities.Don’t miss a beat! Follow us on Twitter.