- Summary:

- DAX index and European peers are down over 2% lower as investor’s attention turns to President Trump tweets that rattled markets as he announced an

DAX index and European peers are down over 2% lower as investor’s attention turns to President Trump tweets that rattled markets as he announced an additional 10% tariffs on the remaining USD300 billion worth of US imports from China, starting September 1st. As of writing, the DAX index trading 2.40 percent lower at 11,957 at two month lows dragged by Infineon -6.6% and BMW down -5.01%. Macro news failed to impress investors after EU June retail sales came in at +1.1% beating expectations of +0.3% m/m, while the EU June PPI came in at -0.6% worse that expectations of -0.3% m/m. Recent disappointing macro news support a dovish tone from ECB as poor economic data may push the European Central Bank to proceed with further stimulus to support the EU economy in September.

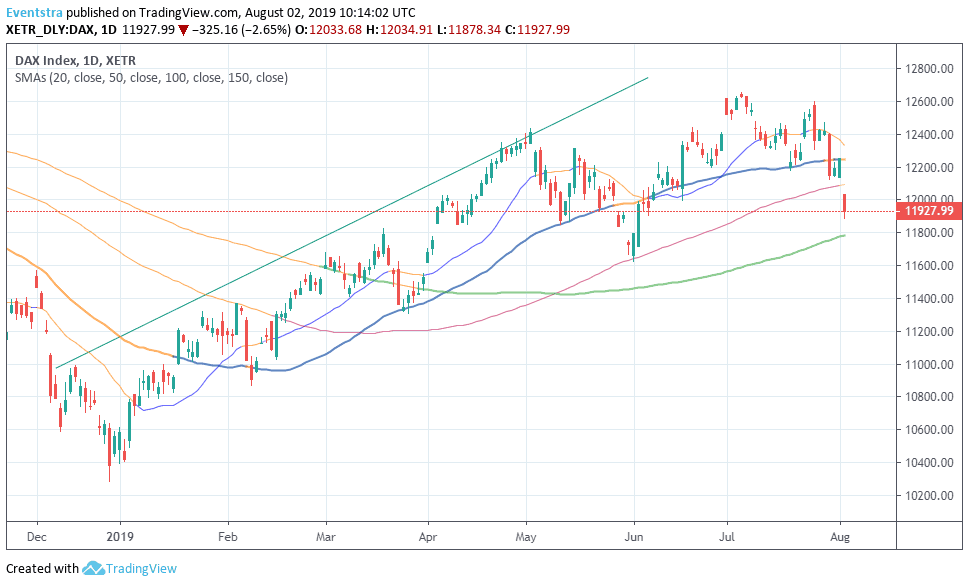

DAX momentum turned negative today as the index broke below the 12,000 mark and the 100 day moving average. Immediate support for the DAX index stands at 11,784 the 150 day moving average while extra bids will emerge at 11,640 the LOW FROM June 3rd. On the upside immediate resistance stands at 12,034 daily high and then at 12,092 the 100 day moving average.

In London the FTSE 100 index gives up 1.89% at 7,441, while CAC 40 is 2.73% lower at 5,405. In Wall Street, the futures also trading lower, the Dow futures are 0.34 percent lower at 26,458 while the S&P futures are 0.42 percent lower at 2,940 and the Nasdaq is 0.70% lower at 7,753, signaling a negative start for U.S. equities.Don’t miss a beat! Follow us on Twitter.