- Summary:

- The DAX index futures tilted lower as the blue-chip German index goes to its biggest revamp on record.

The DAX index futures tilted lower as the blue-chip German index goes to its biggest revamp on record. The DAX 30 index will move to DAX 40 as the owners seek to diversify its constitution. Other indices declined sharply, with the FTSE 100, Dow Jones, and S&P 500 indices also slipped.

DAX 30 to DAX 40

There are three main catalysts for the blue-chip German index this week. First, investors are reacting to the upcoming German election that will see Angela Merkel replaced. The election will take place on Sunday, with polls showing that Angela Merkel’s party was narrowing the SPD poll.

The index is falling because of the rising risks of contagion as China Evergrande stares at bankruptcy. The company has struggled to pay its debt that is worth more than $306 billion. A bankruptcy of China’s biggest developer will hurt the global economy because of the role played by China. It will also be the biggest bankruptcy the world has ever seen since the collapse of Lehman Brothers.

The next key catalyst is the biggest revamp of the DAX index. The index will move from its traditional 30 companies to 40. Some of the new companies that will move into the index are tech firms like HelloFresh and Zalando. Others are Porsche Group and Siemens Healthineers.

Other catalysts moving the DAX index are the upcoming Federal Reserve decision and the latest flash manufacturing and services PMI numbers.

DAX index forecast

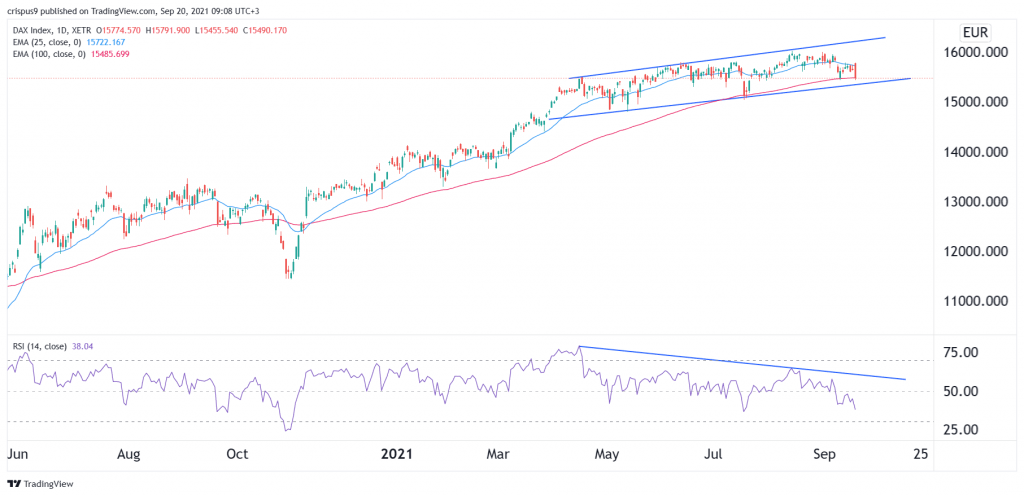

The daily chart shows that the DAX 30 index has struggled lately. The index is trading at €15,490, which is slightly below the year-to-date high of more than €16,000.

The chart shows that the index has even moved below the key support of the 100-day moving average. This is notable since it is the first time since July that the index has tested the support. The Relative Strength Index (RSI) has formed a bearish divergence pattern.

Therefore, there is a likelihood that the index will keep falling as investors target the next key support at €15,000. Still, the index is safe so long as it remains above the lower side of the ascending channel.