- Summary:

- The DAX index is struggling as investors remain concerned about the state of the German economy. What next for the DAX 40 index?

The DAX index is struggling as investors remain concerned about the state of the German economy. The index, which is made up of the biggest companies in Germany, is trading at €12,773, which is a few points above last week’s low of €12,615. It has crashed by 22% from its highest point this year meaning that it is in a bear market.

Uniper bailout: Germany Lehman moment

German stocks have sold off this year as investors worry about the collapse of German companies as the crisis in Ukraine escalates. The biggest worry among corporate leaders in the country is that energy costs will continue rising. This is happening as Germany decouples from the cheap Russian energy products it has been accustomed to for decades.

The impact of the energy crisis is being seen in corporate Germany. The government is holding talks with Uniper, a leading utility company. Analysts expect that the company will receive at least $9.4 billion as it struggles to adjust its business to the new normal. Uniper has seen its stock price crash and is now valued at just $4.14 billion. The company is losing €30 million because of Russia’s curbed flows. In a recent statement, Germany’s economic minister warned that Germany could be facing its Lehman moment as energy companies collapse.

The DAX index is reacting to the relatively weak economic data from Germany. According to the statistics agency, the country’s exports tumbled in May while imports rose slightly. As a result, the country recorded its first monthly trade deficit in decades. This is a sign of what investors expect will happen in the coming months.

The DAX 40 index is also struggling as investors worry about the upcoming rate hike by the European Central Bank (ECB). The era of cheap money in Germany is set to end as the ECB is set to deliver its first and biggest rate hike in more than a decade.

GER30 top movers

Most DAX index constituents are in the red for the year. The Zalando share price has crashed by 64% YTD, becoming the worst performer in the index. Other top laggards in the index are Hello Fresh, Infineon, Puma. and Vonovia, among others. Automakers like Volkswagen, Porsche, Daimler, and BMW have all crashed by over 10% YTD.

DAX index forecast

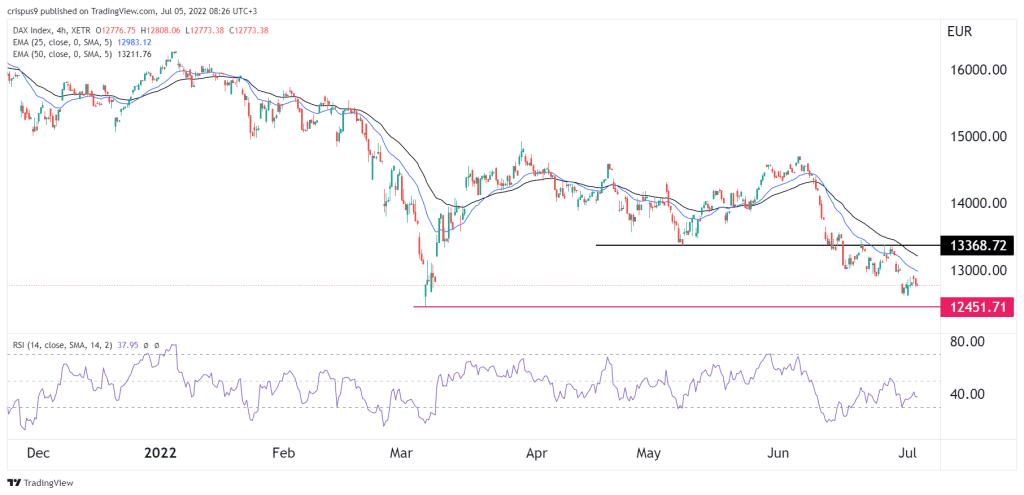

The four-hour chart shows that the DAX 40 index has been in a strong bearish trend in the past few months. Recently, the pair dropped below and then retested the support at €13,368. A break and retest pattern is usually a bearish sign. The stock is also below the 25-day and 50-day moving averages.

Therefore, the index will likely continue falling as bears target the next key support at €12,450. A move above the resistance at €13,000 will invalidate the bearish view. This view is in line with my previous bearish DAX forecast. You can get up-to-date DAX index signals using the highly accurate InvestingCube S&R indicator.