- Summary:

- DAX Down 0.80% as SAP Gives up Over 6%. European indices trade lower today as investor’s attention turns to China-US trade tensions which resurface

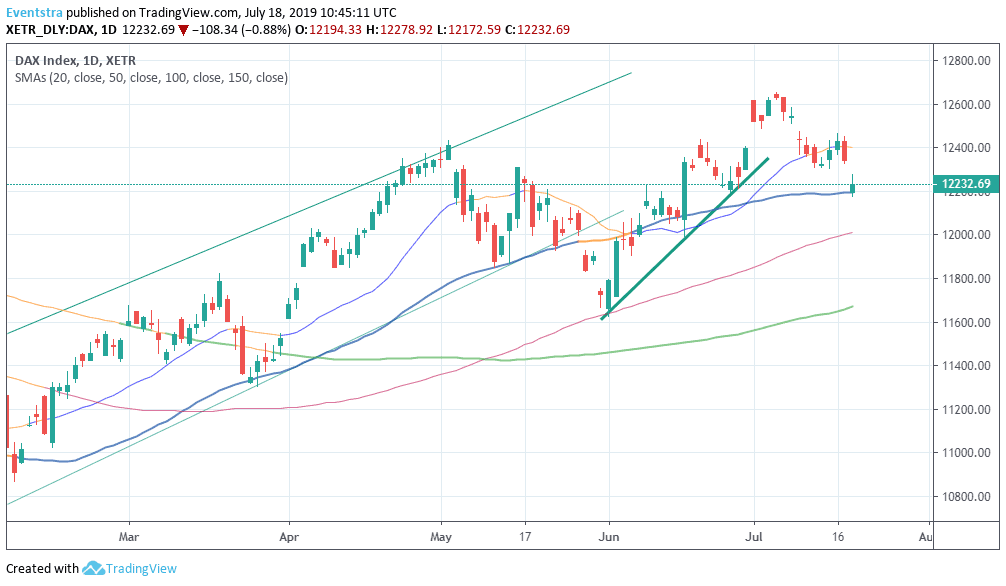

European indices trade lower today as investor’s attention turns to China-US trade tensions which resurface and following the release of disappointing results from Netflix (NFLX). As of writing the DAX 30 is 0.87 percent lower at 12,235 mostly dragged by SAP as its second quarter profits missed expectations and traders are dumping the stock which is now down almost 6%. DAX for now finds support at the 50 day moving average, but looks vulnerable and a leg lower to 12,000 is possible.

CAC 40 in Paris is 0.53 percent lower at 5,543, while in London the FTSE 100 is 0.52 percent lower at 7,496. Earlier today the retail sales data surprised positive investors as the United Kingdom Retail Sales ex-Fuel (year over year) came in at at 3.6% topping expectations of 2.7% in June, the Retail Sales (month over month) came in at 1% above forecasts (-0.3%) in June, and Retail Sales (year over year) came in at 3.8%, beating forecasts of 2.6% in June. InterContinental Hotels and Whitbread downgraded to ‘underperform’ at RBC Capital, while Greggs was also downgraded to ‘reduce’ by Peel Hunt.

In Wall Street, the futures trading lower, the Dow futures are 0.16 percent lower at 27,189 while the S&P futures are 0.11 percent lower at 2,981 and the Nasdaq is 0.22% lower at 7,868, signaling a weak start for U.S. equities.Don’t miss a beat! Follow us on Twitter.