- Summary:

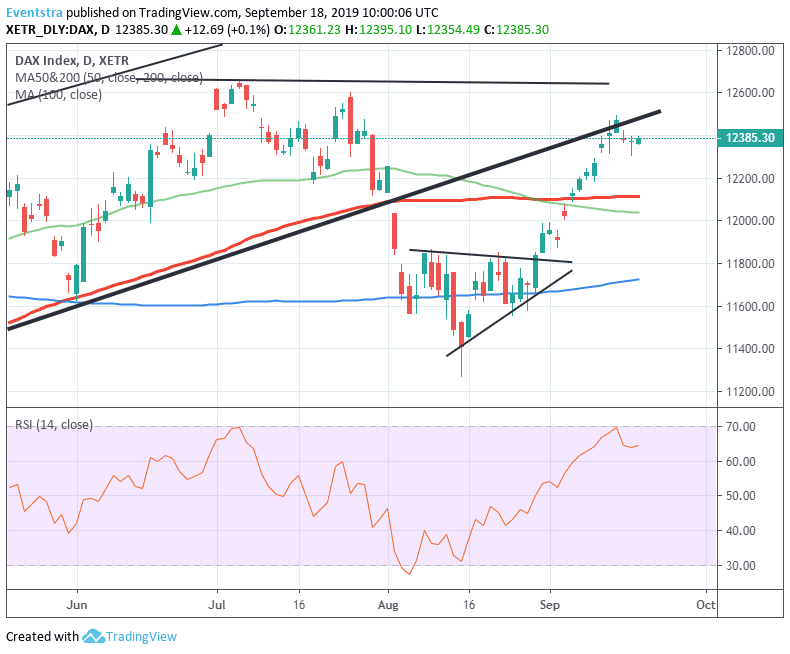

- DAX consolidates close to 4-month highs after the recent impressive rally adding 0.09% at 12,383 ahead of the critical Fed decision and with oil prices

DAX consolidates close to 4-month highs after the recent impressive rally adding 0.09% at 12,383 ahead of the critical Fed decision and with oil prices close to 4-month highs after the drone attack to major oil facilities in Saudi Arabia. Fed is widely expected to lower interest rates by 25 basis points. On the macro data front Consumer Price Index – Core (YoY) came in at 0.9% in line with forecasts for August, the monthly reading for CPI came in at 0.1% below the expectations of 0.2% in August.

ECB last week, cut its deposit interest rate at -0.50% and launched a new round of monthly bond purchases. The German main stock index has gained over 10% since the August lows and 17% in 2019.

DAX positive momentum from August 15th lows is intact despite the recent pullback as the index hovers at six-week highs above all major daily moving averages. On the downside, immediate support for the DAX index stands at 12,354 today’s low while bears need a break below 12,114 the 100-day moving average in order to regain control for the short term and continue the downward move to 12,042 the 200-day moving average. On the upside, the immediate resistance is at 12,395 today’s high and then at 12,592 the high from July 25th, a convincing break above might drive prices to yearly highs at 12,653. Positive momentum will gain traction if Dax return inside the ascending channel which started back in December 2018.