- Summary:

- Darktrace share price has remained at an elevated level in the past few weeks as investors assess the company’s potential acquisition

Darktrace share price has remained at an elevated level in the past few weeks as investors assess the company’s potential acquisition. The DARK stock is trading at 511p, which is slightly below the August high of 560p. The price is about 83% above the lowest point in July, giving it a market cap of over 3.8 billion pounds.

What next for DARK?

Darktrace is a leading cybersecurity company that is headquartered in London. The firm offers its services to over 7,400 companies from around the world. Some of its top customers are firms like Coca-Cola, Jimmy Choo, AT&T Mexico, and Funding Circle among others.

In July, the company said that its revenue in the full year that ended in June rose by 48%. The number of customers rose by 32% while its adjusted EBITDA margin was 19.5%. The company also increased its service offerings by launching the PREVENT product family. The firm’s revenue for the year was $417 million.

The main catalyst for the Darktrace share price is the proposed acquisition by Thoma Bravo, a leading private equity company. In August, the company said that it had held preliminary conversations with the PE company. It warned that there was no certainty that an offer will be made.

Therefore, the next important day to watch will be on September 12 when Thoma Bravo is expected to confirm its bid. If this happens, there is a high possibility that the company will be acquired and not be blocked by UK regulators.

Thoma Bravo can confirm or cancel the acquisition any time before the deadline. Still, according to The Times, other companies are expected to submit their bids for the company. Some of them are Cisco, Palo Alto Networks, and CrowdStrike. If this happens, then there is a likelihood that the DarkTrace share price will have an upside.

There is a high likelihood that Thoma will acquire Darktrace. For one, it has many years of experience investing in cybersecurity companies. Some of its current investments in the sector are Exostar, LogRythm, AppOmni, and Illumio.

Darktrace share price forecast

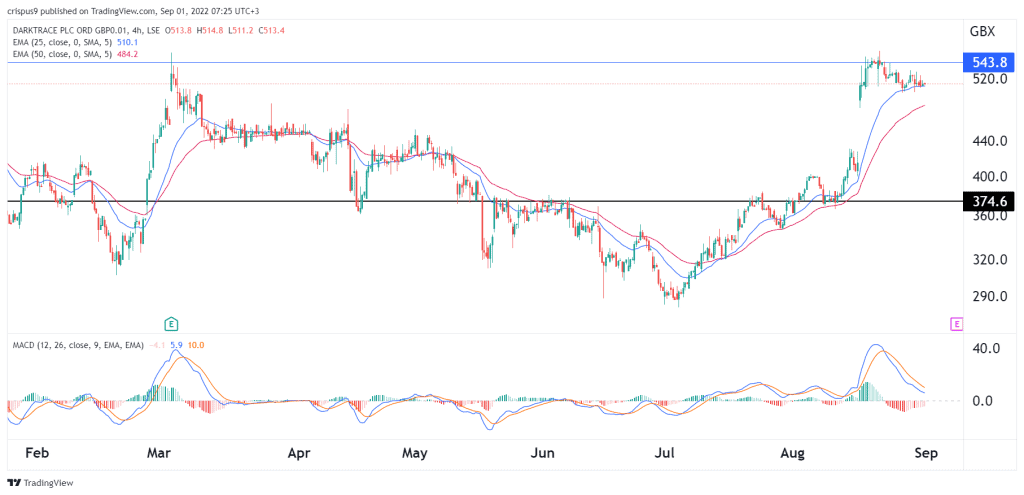

The chart below shows that the DARK share price has been in a strong bullish trend in the past few weeks. The rally accelerated after the buyout rumours emerged. As it rose, the stock moved above key resistance points at 400p and 500p. It also moved above all moving averages.

Now, at this point, the shares’ next major move will be determined by the acquisition. If it happens, the stock will likely rise to over 600p. On the other hand, if Thoma Bravo terminates the deal, the shares will crash to the key support at 375p.