- The EURUSD continues to see further downside as Danske Bank predicts further USD strength in the pairing, targeting 1.16 down the road.

Safe-haven demand for the greenback, as well as new concerns that the Fed may start to abandon the easing pathway earlier than planned, is strengthening the greenback in its pairing with the Euro.

The EURUSD may have gained 0.02 as at the time of writing, but the remains under pressure.

Danske Bank analysts project a price of 1.22 for Q1 2021, representing a downgrade from the earlier monthly forecast of 1.24 and a projection of 1.16 in a 12-month outlook. The outlook stems from the bank’s note of “fading tailwinds for global manufacturing” lower PMI data from China and the Fed starting to tilt towards the hawkish side of the divide as far as the US economy was concerned.

Technical Levels to Watch

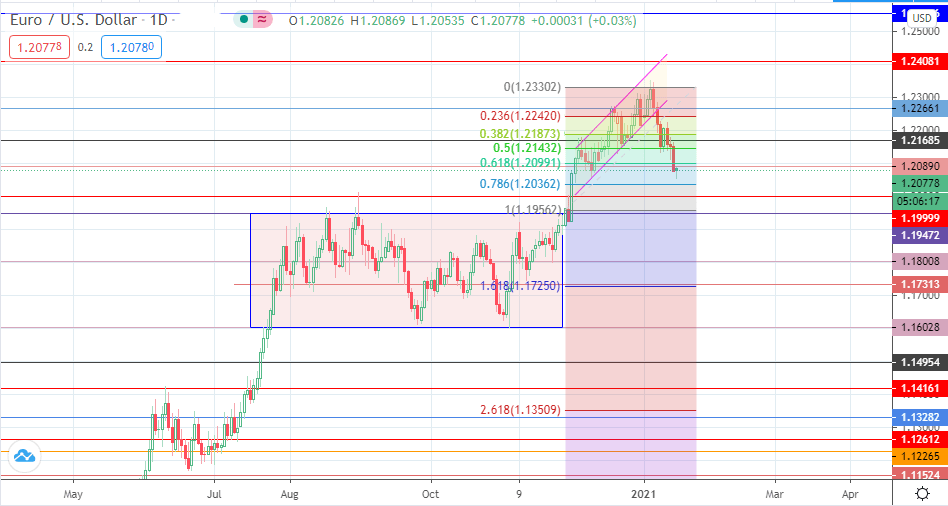

The upside pullback has met resistance at 1.20890. Rejection at this level adds confirmation to Friday’s violation of that support level. This move opens the door towards 1.19999, with 1.20362 (78.6% Fibonacci retracement) serving as a potential pitstop. 1.19472 marks the top of the range of July – October 2020, which becomes a target to the downside further out.

Only if the active candle closes above 1.20890 will bulls make some headway. 1.21685 would be the initial target. Bulls would be seeking a return to 1.24081 for the uptrend to be restored, with 1.22661 being the other resistance that stands in the way.

EURUSD Daily Chart