- Summary:

- Chainlink (LINK) soars to $22.50 after Trump’s World Liberty Finance buys $1M in LINK tokens. Explore why Chainlink is trending.

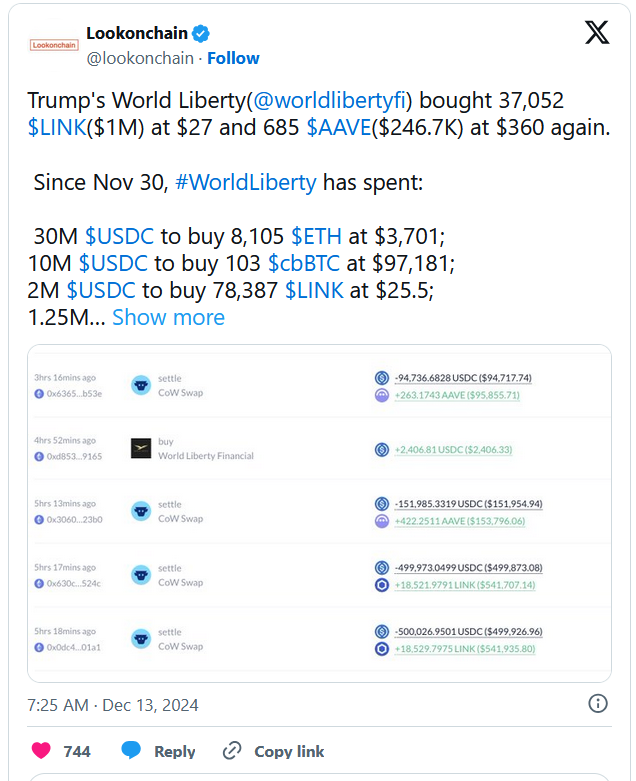

Chainlink (LINK) has surged to its highest levels since 2021, trading at $22.50, after a series of high-profile purchases by Trump’s World Liberty Finance. Recent data shows the firm acquired 37,052 LINK tokens at $27, amounting to $1 million.

Additionally, since November 30, the organization has spent $2 million on 78,387 LINK at $25.50. These strategic investments have reignited interest in Chainlink, driving significant bullish momentum among traders and investors.

Chart Analysis: Key Levels to Watch

- Resistance Levels:

- $23.50: Immediate resistance and the next target for bulls.

- $25.00: A psychological level that could lead to extended upside if breached.

- Support Levels:

- $21.50: Immediate support, crucial for maintaining the uptrend.

- $20.00: A key fallback level if LINK faces selling pressure.

- Moving Averages:

- 20-day EMA ($21.20): LINK is comfortably above this level, indicating strong short-term momentum.

- 50-day EMA ($19.80): Reinforces medium-term bullish sentiment.

Why Chainlink is Trending

The recent spike in LINK’s price follows news that Trump’s World Liberty Finance purchased $1 million worth of Chainlink tokens. This high-profile investment has reignited interest in Chainlink, highlighting its role in providing reliable data for smart contracts in decentralized finance (DeFi). The move underscores growing institutional interest in Chainlink’s capabilities, solidifying its position as a key player in the blockchain space.

Conclusion

Chainlink’s recent rally reflects both technical strength and increased institutional interest. With Trump’s World Liberty backing the project and LINK trading near critical levels, the cryptocurrency could continue to see upward momentum. However, traders should watch for sustained price action above $23.50 to confirm the next leg of the rally.