- Summary:

- Crude oil continues the trip north adding more than 1.24 percent to $59.52 after the Energy Information Administration in its weekly report announced

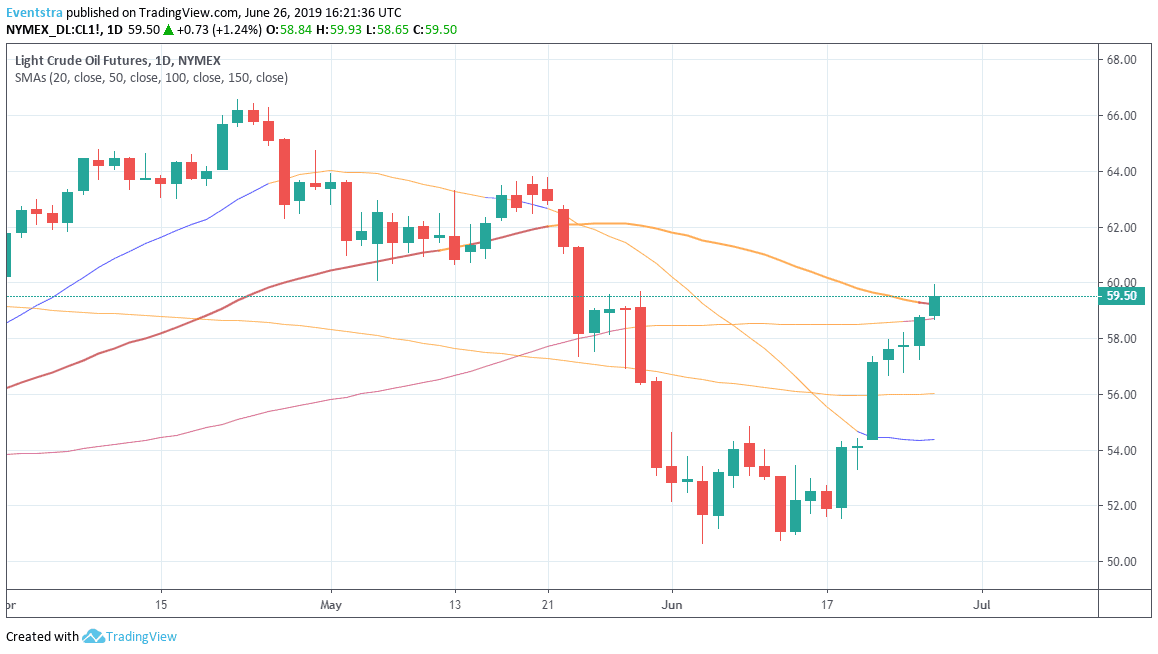

Crude oil continues the trip north adding more than 1.24 percent to $59.52 after the Energy Information Administration in its weekly report announced that the crude oil inventories in the U.S. decreased by 12.8 million barrels from the previous week. Yesterday the American Petroleum Institute reported a reduction of 7.55 million barrels in US crude oil supplies during the previous week. Central bank easing both from RBA, ECB and FED, along with an escalation in USA – Iran tension after President Trump approved new sanctions against Iran, leads to stronger demand for crude oil.

Black gold is in bullish momentum as today the price breached the 50 day moving average and enhances the scenario for another leg higher. The daily high reached at 59.93 while the daily low was at 58.65. The WTI crude oil fell from $66.60 per barrel on 23 April to $50.60 per barrel on June 5th. On the upside first resistance stands at 61.27 the high from May 23rd while next resistance stands at 63.75 the previous month high. Crude oil immediate support stands at 55.96 the 150 day moving average and if the price breaks below, the selloff will intensify and we might test the 20 day moving average at 54.42. Oil traders around the globe await the OPEC’s meeting on production next week that will add volatility to oil price. All in all bulls are in drivers’ seat for now and higher level is on the cards.