- Crude oil prices are heading towards the $80 mark once more, defying the latest buildup in US crude oil inventories.

An unexpected rise in crude oil inventories has done little to dent the uptick in crude oil prices on the day. According to the Energy Information Administration, crude oil inventories rose 4.6million barrels in the week ended 24 September. This figure was more than the 2.5million barrels shortfall that the markets had expected and more than the -3.5million barrels seen a week earlier.

Crude oil inventories were boosted by a return of Gulf Coast production, half of which was knocked by Hurricane Ida some weeks ago. Crude oil imports rose by 87,000 barrels, while refinery utilization rose by 67,000 from the previous week.

The rise in crude oil prices seen today is a function of the Organization of Petroleum Exporting Countries’ plan to slow down supply increases, despite rising global demand. Crude oil prices are up 0.68% on the day.

Crude Oil Price Outlook

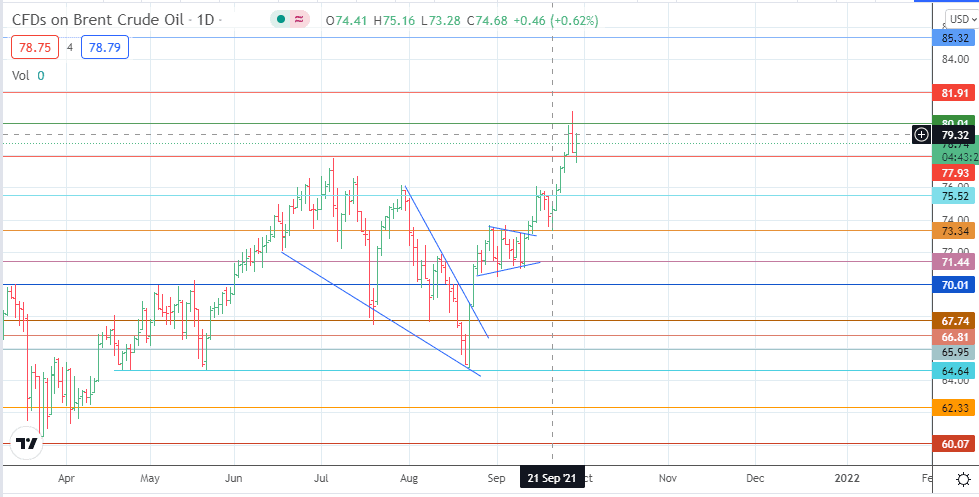

The bounce on the 77.93 support sets up the opportunity for price action to target the most recent high at 80.00. An extension of the advance could bring 81.91 into the mix, with 85.32 serving as an additional price target.

On the other hand, A decline below 77.93 could follow from price rejection at 80.00. If this decline continues, 75.52 and 73.34 come into the picture as additional downside targets.

Crude Oil Price Chart (Daily)

Follow Eno on Twitter.