- Summary:

- WTI rude oil price has resumed the downward slide after a transient recovery on news of increased China imports. Downside may be limited.

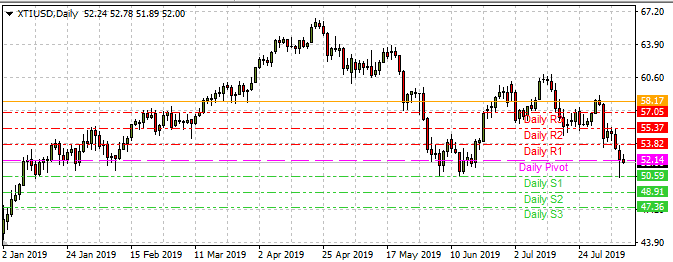

Crude oil prices are heading downwards, but this move may be limited as news of stronger Chinese demand and discussions of a cut in production by OPEC’s key players hit the newswires. Indeed, WTI crude oil price bounced off the $50.59 price support (June 5 and 6 lows), before being sent down again by sellers. WTI presently trades at $51.90.

The transient recovery of crude oil price was mainly due to the reports of talks between players of the Organization of Petroleum Exporting Countries (OPEC) being convened by Saudi Arabia to discuss possible production quota cuts. The other factor which boosted oil prices overnight was data that showed that China’s oil imports had climbed for the month of June.

However, this rally was dampened by the EIA crude oil inventories report and the renewed risk on sentiment which arose from fears of an escalation of the US-China trade war.

WTI Crude Technical Setup

Continued downside moves will challenge the support at $50.59 (S1 pivot support). A downside break of the S1 pivot will bring $48.91 and $47.26 into focus. A bounce off 50.59 will lead to a retest of the $52.14 price level and possibly the $53.82 resistance above this level.