- Summary:

- Crude oil price rises to February 2020 highs after Saudi Arabia announced it would extend oil cuts in February and March 2021.

Crude oil price on the WTI and Brent crude benchmarks rose to 11-month highs after Saudi Arabia announced plans to shave an additional 1 million barrels per day in February and March. Crude oil price was bolstered by Saudi Arabia’s decision to unilaterally cut output last week, and this follow-up move appears to have offset potential demand concerns as coronavirus cases rise across the world.

Crude oil price on the Brent crude benchmark is up 1.56% currently, as crude oil prices make a bright start to a year that had been forecast by OPEC and the IEA to be one where oil demand would suffer. Also helping the outlook is the mass vaccination campaigns across the developed world, which is expected to curtail the spread of the coronavirus just enough to restore demand to pre-pandemic levels.

Technical Levels to Watch

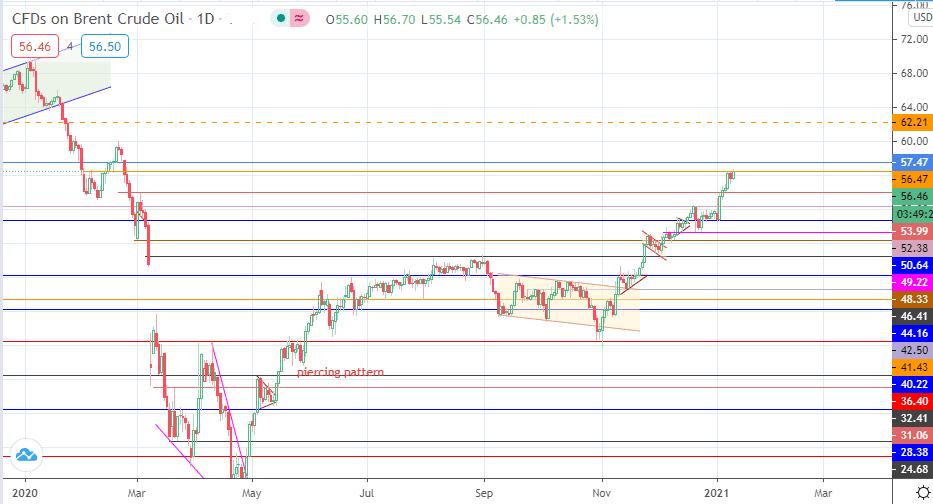

Today’s surge has put the 56.47 price level at risk. If bulls take out this price level, then 57.47 becomes the next available target and this would send prices towards February 2020 highs.

On the flip side, a rejection and pullback from the current resistance sends price towards the 53.99 support, with 52.38 and 50.64 serving as additional downside targets.

Crude Oil Price; Daily Chart