- Crude oil prices slide nearly 6% on news of the emergence of a new coronavirus variant and potential downside risks to demand.

Crude oil prices have fallen heavily after a new variant of the COVID-19 virus was identified in South Africa and Botswana.

The news has already triggered a travel ban from the UK on six countries in Southern Africa, triggering fears that new travel restrictions and lockdowns could trigger a loss of oil demand.

This development comes on the back of the US announcement on Wednesday that it was releasing 50 million barrels from its strategic reserves to bring down prices. It also affirms the OPEC + argument that it could not go beyond a 400,000 barrels per day increase because downside risks to oil prices remained.

Crude Oil Price Outlook

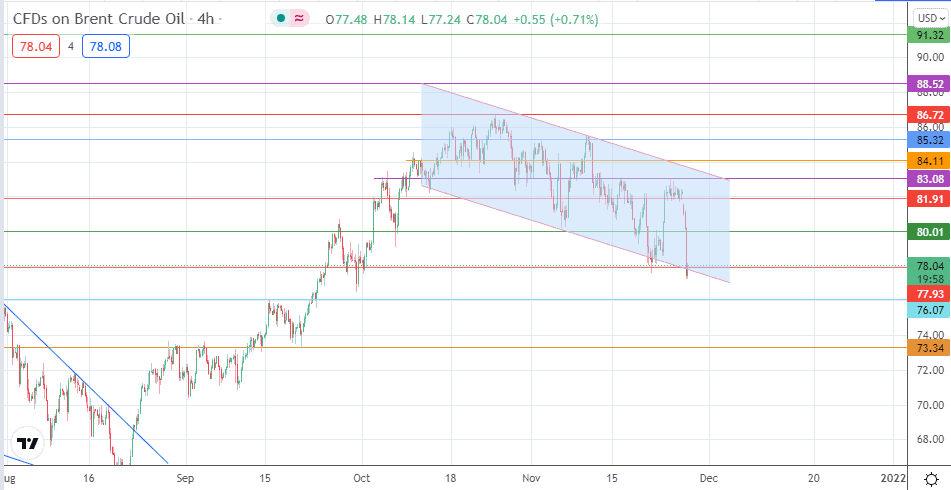

The Brent crude benchmark is presently testing support at 77.93. A breakdown of this level attracts more shorts that could send the price towards the 76.07 price support. 73.34 is the target to the south, which comes into the picture if the decline continues.

On the flip side, a bounce of the price on the current support allows the 80.00 psychological resistance to come into the picture. 81.91 and 83.08 are short-term price barriers to the upside, which may become rally-selling areas if the descending trendline is respected.

Brent Crude: 4-hour Chart